The financial landscape in Nigeria has long been shaped by a mix of new-age fintechs, traditional banks, and an ever-growing number of loan apps. Despite this influx of solutions, the credit landscape remains one of the most underdeveloped in the world. A staggering 8 out of 10 African income earners who could be eligible for credit are still shut out, while their counterparts in the western world benefit from consumer credit systems that empower them to live and thrive financially.

Beyond this glaring credit gap, existing solutions often fail to address the deeper needs of consumers. While loan apps and other offerings may provide temporary relief, they typically come with high interest rates, short repayment terms, and little to no support for building lasting financial health. This leaves many people stuck in a cycle of debt with no clear path forward.

MAXIM is here to rewrite the narrative—not as just another player in the credit game but as a game-changer that offers something fundamentally different.

Let’s explore how MAXIM is transforming access to credit in Nigeria and why it’s the opportunity you’ve been waiting for.

The Problem With Traditional Credit Options

If you’ve ever applied for a loan or tried to secure a credit card in Nigeria, you know the drill. It’s a mix of hurdles:

- Strict requirements: Traditional banks ask for extensive paperwork, high collateral, and pristine credit histories.

- Short-term focus: Loan apps, while convenient, focus on quick fixes with exorbitant interest rates and rigid repayment structures.

- Lack of trust: Many Nigerians are wary of loan apps due to issues like privacy breaches and aggressive collection practices.

The bottom line? These options don’t prioritize your financial growth or set you up for long-term success.

The Problem With Loan App Options

While loan apps have flooded the Nigerian market, offering quick access to credit, they come with several significant downsides that leave many users in a cycle of financial strain. These apps, though popular, often fall short of providing sustainable, long-term financial solutions. Here are some of the key issues:

- High Interest Rates

One of the most glaring issues with many loan apps is the exorbitant interest rates they charge. Unlike traditional lending institutions, these apps often have extremely high annual percentage rates (APRs), making borrowing expensive and difficult to repay. For many users, this means that what starts as a small loan can quickly snowball into an unmanageable debt due to the compounded interest. - Unethical Practices

A concerning number of loan apps engage in unethical practices that prey on vulnerable borrowers. Some apps resort to aggressive collection tactics, including harassment, threats, or even shaming users on social media platforms when repayments are missed. These practices create a toxic environment for consumers and can cause severe emotional and financial distress. - Reapplication Every Time You Need Credit

Loan apps often force users to reapply for credit every time they need it. There’s no consistent line of credit or loyalty system in place, which means each new borrowing cycle involves tedious paperwork and waiting times. This makes it difficult for borrowers to plan their finances, as they’re unsure when they’ll be approved or how much they can access. - Focus on Short-Term, Transactional Purposes

Most loan apps are designed for short-term, transactional lending, typically offering small, quick loans meant for immediate, one-time expenses. These loans are not geared towards helping users build long-term financial health or improving their creditworthiness. As a result, users are stuck with a short-term solution that doesn’t help them grow financially or access larger credit in the future. - No Support for Building Financial Health

While loan apps offer quick cash, they fail to help users build their credit scores or financial profiles. There’s no focus on improving long-term financial health, and in many cases, users are left worse off after taking loans due to the high interest rates and quick repayment demands. The lack of financial education or guidance often means that users are simply borrowing to get by, without understanding how it impacts their overall financial well-being. - Lack of Flexibility

Loan apps usually operate with rigid terms that don’t cater to the varying financial circumstances of their users. There’s little to no flexibility in repayment options, and the small loan amounts often don’t meet the real financial needs of the borrower. This inflexibility makes it hard for people to plan their repayments, leading to missed payments and increasing debt. - Lack of Transparency

Many loan apps fail to disclose all the costs involved in borrowing upfront. Hidden fees, sudden interest hikes, or unclear repayment structures can lead to confusion and mistrust. This lack of transparency often results in borrowers being blindsided by their debts, which compounds the financial difficulties they’re already facing.

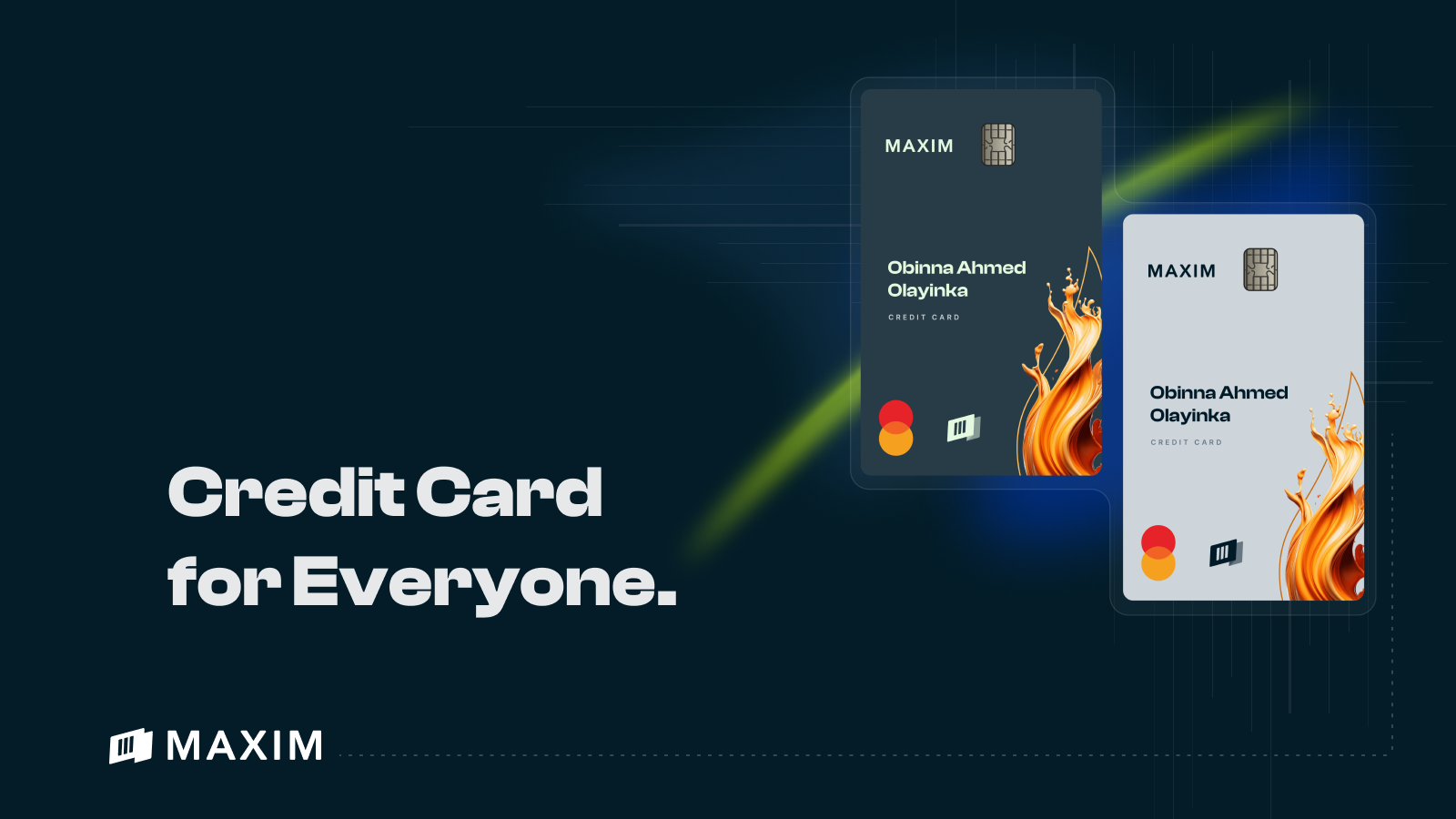

MAXIM CREDIT CARD: Credit for Everyone, Built for the Future

MAXIM isn’t just an improvement on existing options—it’s an entirely new way to think about credit. Unlike loan apps that offer short-term solutions, MAXIM is designed to help you build financial stability, enhance your creditworthiness, and unlock better opportunities over time.

Here’s how MAXIM is changing the game:

1. Not Just Loans, but Empowerment

With MAXIM, you’re not just borrowing money; you’re unlocking tools to build your financial future. For instance:

- The MAXIM Credit Card gives you access to affordable credit while encouraging smart spending habits.

- The Expense Card helps those who are not yet eligible for credit cards build their credit profile with everyday expenses.

Instead of offering one-time fixes, MAXIM empowers you to grow your financial confidence and capabilities.

2. Accessible Credit for All

We get it—many Nigerians don’t have perfect credit histories. That’s why MAXIM is inclusive by design.

- If you don’t meet the criteria for a MAXIM Credit Card, the Expense Card is your gateway to earning your way in.

- Our system tracks positive financial behavior—like saving regularly or paying bills on time—to help you qualify for credit over time.

Whether you’re a freelancer, salary earner, or self-employed, MAXIM provides a path to credit that works for you.

3. Say Goodbye to Hidden Charges and Exploitative Rates

Loan apps in Nigeria are notorious for sneaky charges and sky-high interest rates. MAXIM is different:

- Transparent fees: No hidden surprises. What you see is what you pay.

- Competitive rates: We offer fair and sustainable credit solutions, making borrowing stress-free.

We believe credit should work for you—not against you.

4. A Fully Digital and Hassle-Free Experience

MAXIM is built for the modern Nigerian. With our user-friendly app, you can:

- Apply for credit in minutes.

- Track your spending and repayments.

- Earn rewards for responsible financial behavior.

No long queues. No unnecessary paperwork. Just seamless, efficient credit access wherever you are.

5. A Vision Beyond Borrowing

MAXIM is about more than credit—it’s about changing lives.

- Build your credit score with every transaction.

- Access premium benefits through our tiered membership system, including Premier, Elite, Signature, and Prestige Cards.

- Unlock opportunities like higher credit limits and exclusive offers as your financial profile improves.

We’re not just here to lend money; we’re here to help you build wealth and financial independence.

Why MAXIM Is Perfect for Nigeria

Nigeria is a vibrant, fast-paced economy with endless potential—but many Nigerians are held back by limited credit options. MAXIM bridges this gap by offering solutions tailored to your needs, lifestyle, and ambitions.

Whether you’re looking to:

- Pay for urgent expenses,

- Build your creditworthiness for future goals, or

- Upgrade your financial lifestyle,

MAXIM is your partner every step of the way.

How to Get Started With MAXIM

It’s easy to join the MAXIM family.

- Visit our website or download the MAXIM app.

- Choose the product that best suits your needs—be it a credit card, Expense Card, or savings account.

- Follow the simple onboarding process, and you’re good to go!

Your Financial Revolution Starts Now

MAXIM isn’t just another credit provider—it’s a movement. A revolution designed to give Nigerians the credit they deserve, the support they need, and the opportunities they’ve been waiting for.

So, are you ready to change the game with us?

Explore MAXIM today and discover a brighter financial future.