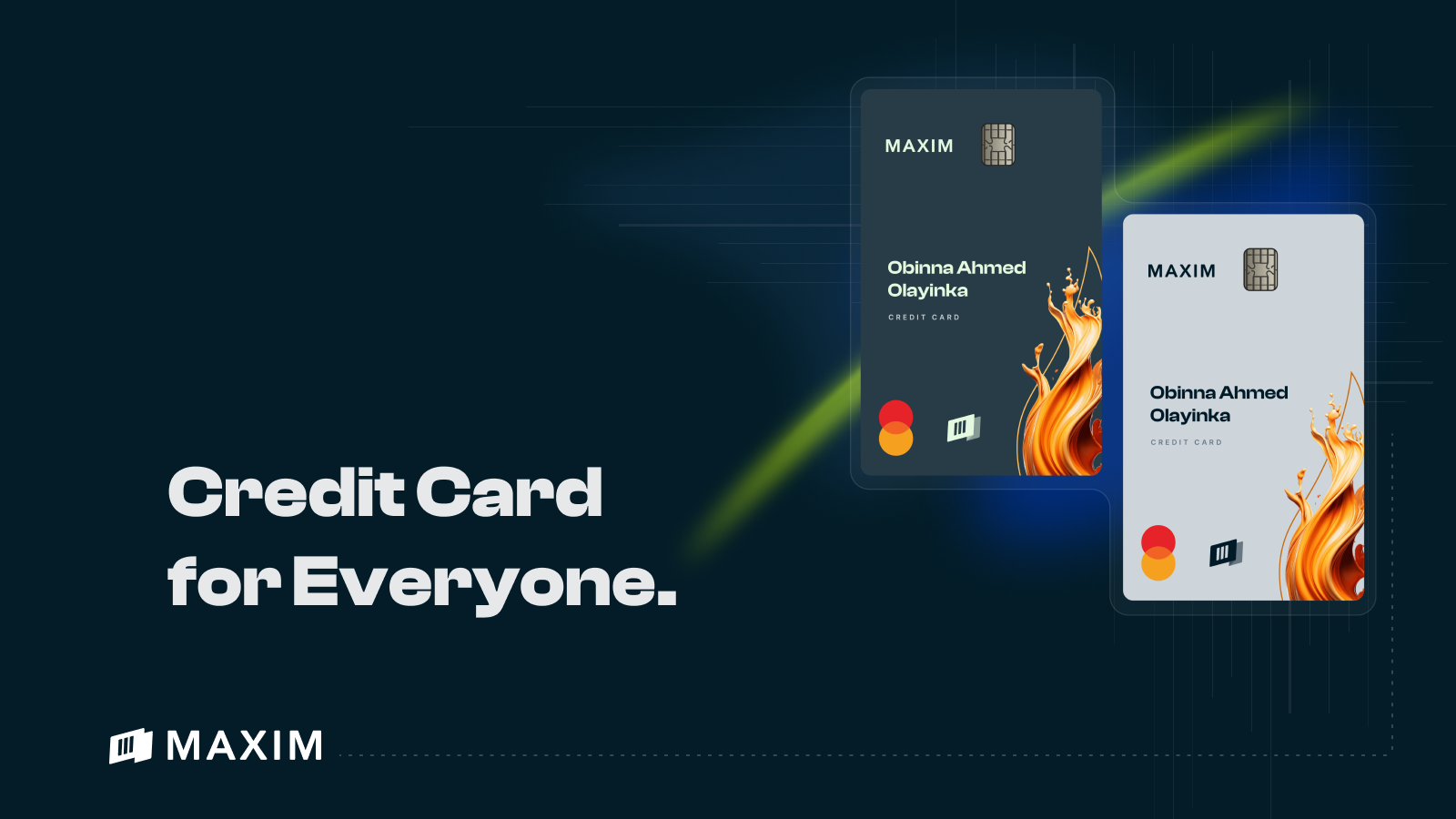

Why MAXIM Credit Card Is the Perfect Tool for High-Value Transactions.

When it comes to making high-value transactions, Nigerians are often stuck between a rock and a hard place. Loan apps might seem like a quick fix, but their high-interest rates, limited borrowing power, and short repayment windows make them far from ideal for significant financial decisions. MAXIM Credit Card changes the game entirely.

This isn’t just another credit solution; it’s a smarter, more flexible way to handle big-ticket expenses without the stress of high-interest loans or restrictive credit limits. If you’ve been searching for a better tool to fund high-value transactions, here’s why the MAXIM Credit Card should be your top choice.

The Challenges of High-Value Transactions in Nigeria

For many Nigerians, making high-value purchases such as paying for higher education, medical bills, or business equipment often means resorting to cash, loans, or borrowing from family and friends. However, these options come with their own set of challenges:

- Low Loan Limits

Many loan apps cap borrowing limits at around ₦50,000 to ₦100,000, which is far from enough for large purchases. - High-Interest Rates

Loan apps charge exorbitant interest rates, sometimes exceeding 30-120% annually, which significantly increases the overall cost of any transaction. - No Flexibility

Once you take a loan, you’re locked into fixed repayment schedules with little to no room for adjustments. - No Financial Growth

Loans don’t contribute to building creditworthiness, which limits your financial options in the future.

Why MAXIM Credit Card Stands Out

The MAXIM Credit Card offers a refreshing alternative, designed to handle high-value transactions without the stress and constraints of traditional credit solutions. Here’s how MAXIM excels where others fall short:

1. Higher Credit Limits for Big Expenses

Unlike loan apps with low caps, MAXIM Credit Card provides access to higher credit limits, allowing you to make significant purchases with ease. Whether it’s a new car, international travel, or funding a business expansion, MAXIM ensures you have the financial power to make it happen.

2. Zero-Low Interest Rates (T&Cs Apply)

High-interest rates are a major deterrent for loans, but MAXIM offers zero-low interest rates, making it affordable to fund your high-value transactions without worrying about ballooning debt.

3. Flexible Repayment Options

With MAXIM, you enjoy the flexibility of a revolving credit line, meaning you only pay for what you use and can repay at your own pace (T&Cs apply). This level of customization ensures that you’re never overwhelmed by repayment pressures.

4. Reward Points for Every Naira Spent

Every transaction with the MAXIM Credit Card earns you reward points that can be redeemed for cashback, discounts, or even higher credit limits. It’s like getting rewarded for spending smartly.

5. Boosts Your Creditworthiness

Unlike loans that don’t help you build financial stability, the MAXIM Credit Card contributes to your credit score growth, opening doors to more significant financial opportunities in the future.

Real-Life Scenarios: How Nigerians Use MAXIM for High-Value Transactions

Scenario 1: Funding a Dream Wedding

Bola and Tunde wanted a dream wedding but found it difficult to secure the necessary funds through traditional loans. The MAXIM Credit Card gave them access to a high credit limit with zero-low interest, allowing them to pay for vendors and services while spreading their repayments over time.

Scenario 2: Expanding a Business

Uche runs a thriving small business in Lagos but needed more equipment to meet growing demand. Loan apps offered low borrowing limits and short repayment periods, making them impractical. With the MAXIM Credit Card, Uche was able to purchase the equipment outright and repay gradually while still earning points for his transactions.

The MAXIM Advantage vs. Loan Apps

| Feature | Loan Apps | MAXIM Credit Card |

| Credit Limit | Low, ₦50,000-₦100,000 | High, flexible credit limits |

| Interest Rates | High, 30%-120% annually | Zero-low (T&Cs apply) |

| Repayment Options | Fixed, short-term | Flexible, revolving credit line |

| Creditworthiness Impact | No credit-building opportunities | Helps build credit score |

| Additional Benefits | None | Rewards, cashback, perks |

The Economic Benefits of High-Value Transactions

High-value transactions drive economic growth, whether they involve starting a business, pursuing higher education, or investing in property. Yet access to the financial tools needed for such transactions remains limited in Nigeria. According to the World Bank, only 27% of Nigerians have access to formal credit, leaving millions without the means to achieve their financial goals.

By offering higher credit limits and flexible terms, MAXIM Credit Card empowers Nigerians to participate more actively in the economy. It’s not just about providing credit—it’s about enabling growth.

How to Get Started with MAXIM Credit Card

- Apply for the MAXIM Expense Card: Start building your financial profile and earning points from everyday spending.

- Upgrade to the MAXIM Credit Card: Once you’ve earned enough points, unlock access to higher credit limits and exclusive benefits.

- Use Your Credit Smartly: Whether it’s for business, personal expenses, or emergencies, MAXIM is your go-to tool for managing high-value transactions.

High-value transactions shouldn’t come with high levels of stress. With the MAXIM Credit Card, Nigerians finally have access to a credit solution that combines higher limits, low costs, and flexibility—making it the perfect tool for significant financial goals.

Say goodbye to the limitations of loan apps and embrace the future of financial independence with MAXIM Credit Card.