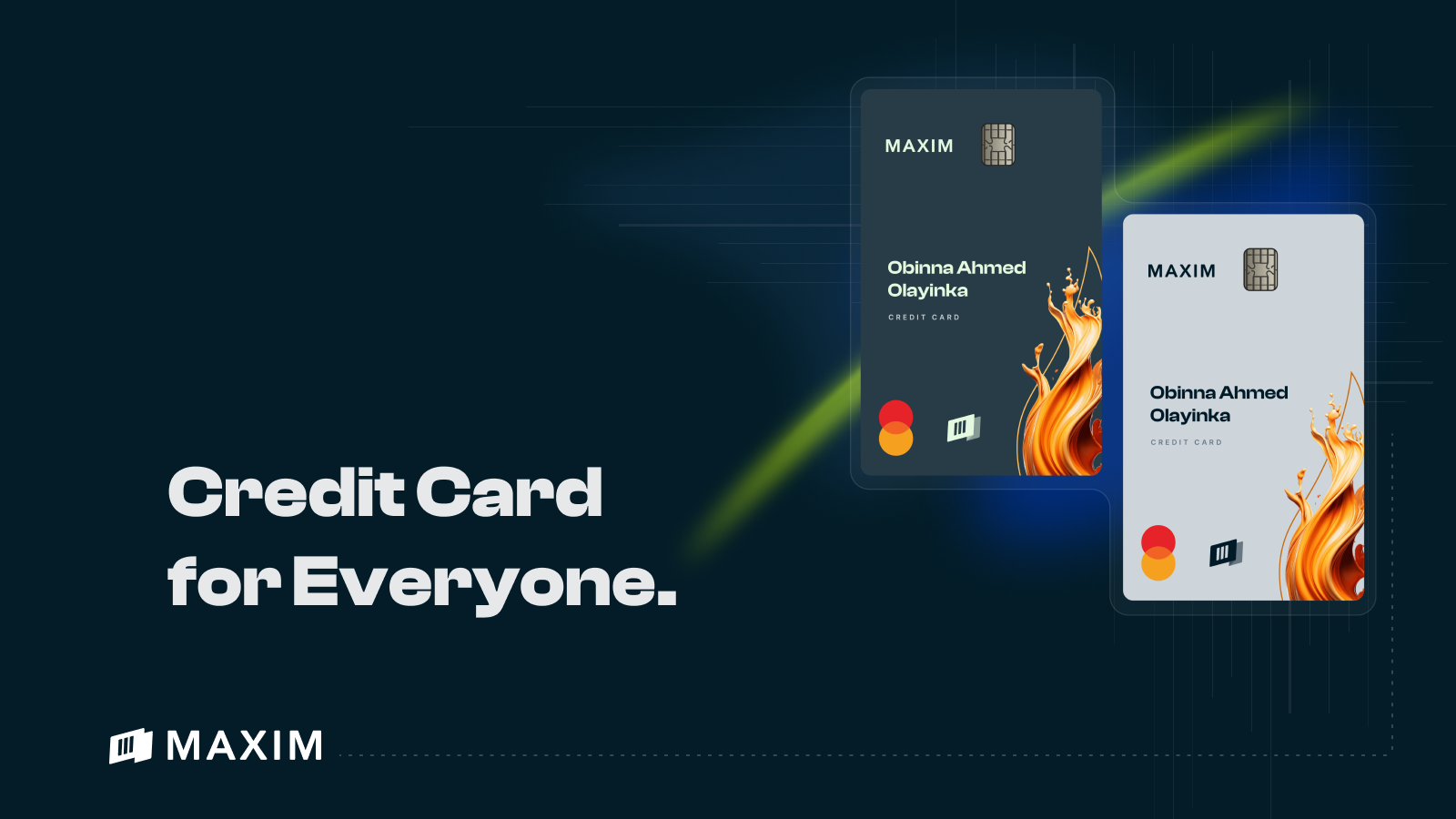

Which One’s Right for You?

When it comes to credit cards, not all are created equal—and MAXIM takes that concept to the next level. With its unique tiered structure, the MAXIM Credit Card offers a personalized experience that matches your lifestyle and spending habits. Whether you’re just getting started or are looking for something a bit more exclusive, there’s a MAXIM tier that fits your needs perfectly. Let’s break it down!

Why Does MAXIM Have Different Membership Tiers?

The MAXIM Credit Card is designed to be as flexible and dynamic as your life. Different people have different financial goals, so rather than a one-size-fits-all approach, MAXIM gives you a range of four distinct membership tiers, each with its own perks and privileges. The higher the tier, the more exclusive the benefits—but the entry-level options are no slouch either!

Each tier also has a flat monthly membership fee , and the features get progressively better as you move up. No matter where you start, you’re getting value, rewards, and an experience tailored to you.

Think of the Premier tier as your gateway into the MAXIM universe. It’s perfect for anyone who’s just starting their credit journey or wants a card for daily spending without the frills but still wants access to basic perks.

What You Get:

- Flat monthly fee to keep things simple

- Purchase protection for peace of mind

- Rewards points on every purchase

It’s the ideal first step if you’re looking for a straightforward credit card with zero hassle. The Premier tier sets you up to manage your credit responsibly while enjoying the essential benefits of the MAXIM experience.

Ready for more? The Elite tier is designed for those who want a bit more luxury in their life without going full high-roller. It’s great if you’re managing a slightly larger budget, with added benefits that bring extra value to your everyday life.

What You Get:

- All the perks of Premier plus…

- Higher credit limits for larger purchases

- Increased rewards points on travel, dining, and lifestyle spending

- Access to premium events and exclusive deals

Elite is for people who want to elevate their spending power and earn more points for those bigger purchases. It’s the perfect balance between practical and premium.

Ready for more? The Elite tier is designed for those who want a bit more luxury in their life without going full high-roller. It’s great if you’re managing a slightly larger budget, with added benefits that bring extra value to your everyday life.

What You Get:

- All the perks of Premier plus…

- Higher credit limits for larger purchases

- Increased rewards points on travel, dining, and lifestyle spending

- Access to premium events and exclusive deals

Elite is for people who want to elevate their spending power and earn more points for those bigger purchases. It’s the perfect balance between practical and premium.

If you want nothing but the best, the Prestige tier is your destination. This is MAXIM’s top-level offering, and it comes packed with premium perks that’ll make every swipe of your card feel like VIP treatment.

What You Get:

- All the perks of Signature, plus…

- Unlimited credit limits for unparalleled spending power

- Exclusive invitations to luxury events and experiences

- Health insurance and access to top-tier wellness programs

- A personal concierge to handle your every request, from travel to lifestyle

- No card fees—just one monthly membership fee that covers everything

Prestige is for the high-flyers, the trendsetters, and those who want nothing but the finest. It’s all about living life on your terms and having a card that supports your every move.

How to Move Between Tiers

The great thing about MAXIM? You’re never locked into one tier. As your credit habits improve and your spending evolves, you can move up to higher tiers over time. You also accumulate points with every purchase, which can help you upgrade to the next tier. And don’t worry, you’re not stuck with annual fees or penalties—MAXIM keeps it flexible.

Which MAXIM Tier is Right for You?

- If you’re looking for simplicity and want to build credit, Premier is a great place to start.

- Want a little more spending power and rewards without going overboard? Go with Elite.

- If you’re all about premium perks and experiences, Signature will open doors (literally, with VIP access). But you can only be invited to join

- For the ultimate experience, Prestige gives you unrivaled access to the world’s most exclusive events, services, and benefits. But you can only be invited to join

Wrapping It Up

The different tiers of the MAXIM Credit Card aren’t just levels—they’re personalized experiences that adapt to your lifestyle and financial goals. Whether you’re just starting your credit journey or are ready to live the VIP life, MAXIM has the perfect card for you.

And with zero interest and just a flat monthly fee, you can focus on enjoying the perks without worrying about interest rates and hidden charges. Ready to find out which tier fits your style? The MAXIM experience awaits!