In a country where financial solutions are often limited to short-term loans and restrictive credit products, it’s no wonder that many Nigerians are looking for something better, something more flexible. If you’re tired of high-interest loans, unpredictable repayment schedules, and low borrowing limits, the MAXIM Credit Card offers the freedom and flexibility you’ve been waiting for.

Unlike traditional loans and limited credit options, MAXIM gives you the ability to manage your finances on your terms, all while building a solid foundation for your financial future. Let’s explore why MAXIM Credit Card is the perfect solution for Nigerians who want more out of their credit experience.

Why Traditional Credit and Loan Apps Fall Short for Nigerians

When it comes to financial products in Nigeria, the options available often come with significant downsides:

- High-Interest Rates

Loan apps and traditional credit products can often come with sky-high interest rates, sometimes as high as 100% per annum. This means that what starts as a small loan quickly escalates into a massive repayment burden, especially for those unable to meet the strict payment deadlines. - Low Credit Limits

Many loan apps cap the amount you can borrow at around ₦50,000 to ₦100,000. While this may seem like enough for small emergencies, it’s hardly sufficient when it comes to more significant financial needs like buying a car, paying for school fees, or even running a small business. - No Room for Growth

Borrowing from traditional banks or using loan apps does nothing to help you build long-term financial health. Most of these options don’t offer the opportunity to grow your credit score, leaving you stuck in a cycle of borrowing with no way to increase your creditworthiness. - The Hassle of Reapplication

Need another loan? Start the process all over again. Loan apps force you to go through the same tedious application process every time you need funds, and there’s no guarantee that you’ll get approved.

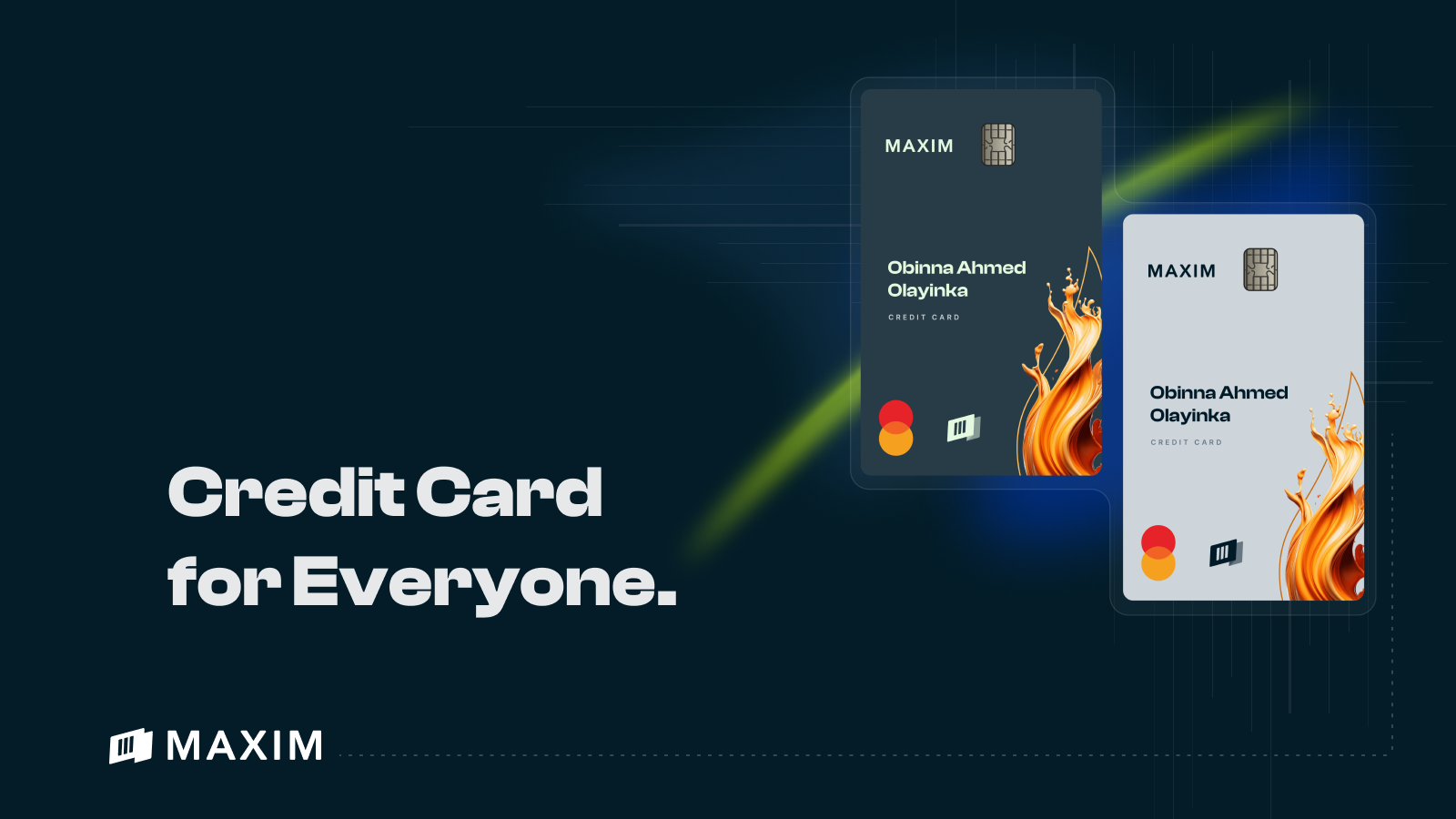

Enter MAXIM Credit Card: Where Flexibility Meets Financial Freedom

The MAXIM Credit Card is here to break all those barriers. Designed with Nigerians in mind, MAXIM offers a new kind of credit that’s not just about borrowing money but about giving you real financial flexibility. Here’s how it works:

1. Higher Credit Limits for Bigger Financial Goals

Loan apps are notorious for low credit limits. With MAXIM, however, you get access to higher credit limits—allowing you to take on bigger purchases or handle larger expenses without needing to constantly reapply for loans. Whether it’s a business expansion, a big-ticket purchase, or an emergency fund, MAXIM gives you the resources to cover it all.

2. Zero-Low Interest Rates (T&Cs Apply)

Unlike loan apps, where high-interest rates can quickly drain your pockets, MAXIM comes with zero-low interest rates that make repayments manageable and affordable. With the MAXIM Credit Card, you won’t be hit with surprise fees or an ever-growing balance.

3. Revolving Credit Line for Ongoing Flexibility

The beauty of the MAXIM Credit Card lies in its revolving credit line. Once approved, you can access your credit limit whenever you need it, whether it’s for everyday expenses, large purchases, or unexpected costs. This flexibility means you only pay for what you use, and your credit line stays open as long as you maintain good repayment habits.

4. Credit-Building Benefits

Building your credit score has never been easier. MAXIM’s credit card allows you to build your credit history, which is essential for future financial endeavors. Whether you’re applying for a loan, a mortgage, or even starting a business, a good credit score opens the door to better opportunities.

5. Access to Rewards & Perks

Every time you use the MAXIM Credit Card, you earn reward points. These points can be redeemed for exciting perks or used to upgrade your credit limit. Plus, MAXIM offers a variety of benefits tailored to help you get more out of your purchases, whether it’s through cashback, travel discounts, or exclusive offers from partner brands.

Real-Life Scenarios: MAXIM Credit Card in Action

Scenario 1: Managing Day-to-Day Expenses with Flexibility

Lola, a working professional in Lagos, had been using loan apps for recurring expenses. However, she often found herself juggling multiple apps with different repayment deadlines, adding stress to her already busy life. With MAXIM, Lola now has a single credit line she can rely on whenever she needs it. No more reapplications or multiple payments—just easy access to the funds she needs when she needs them.

Scenario 2: A Small Business Owner’s Best Friend

For Jide, a small business owner in Abuja, having access to quick cash is crucial for day-to-day operations. But with loan apps capping his borrowing limit at ₦50,000, Jide was finding it hard to cover larger expenses like inventory purchases or staff wages. With MAXIM Credit Card, Jide now has a higher credit limit and ongoing access to a flexible line of credit that helps him keep his business running smoothly.

The MAXIM Credit Card vs. Loan Apps: A Clear Advantage

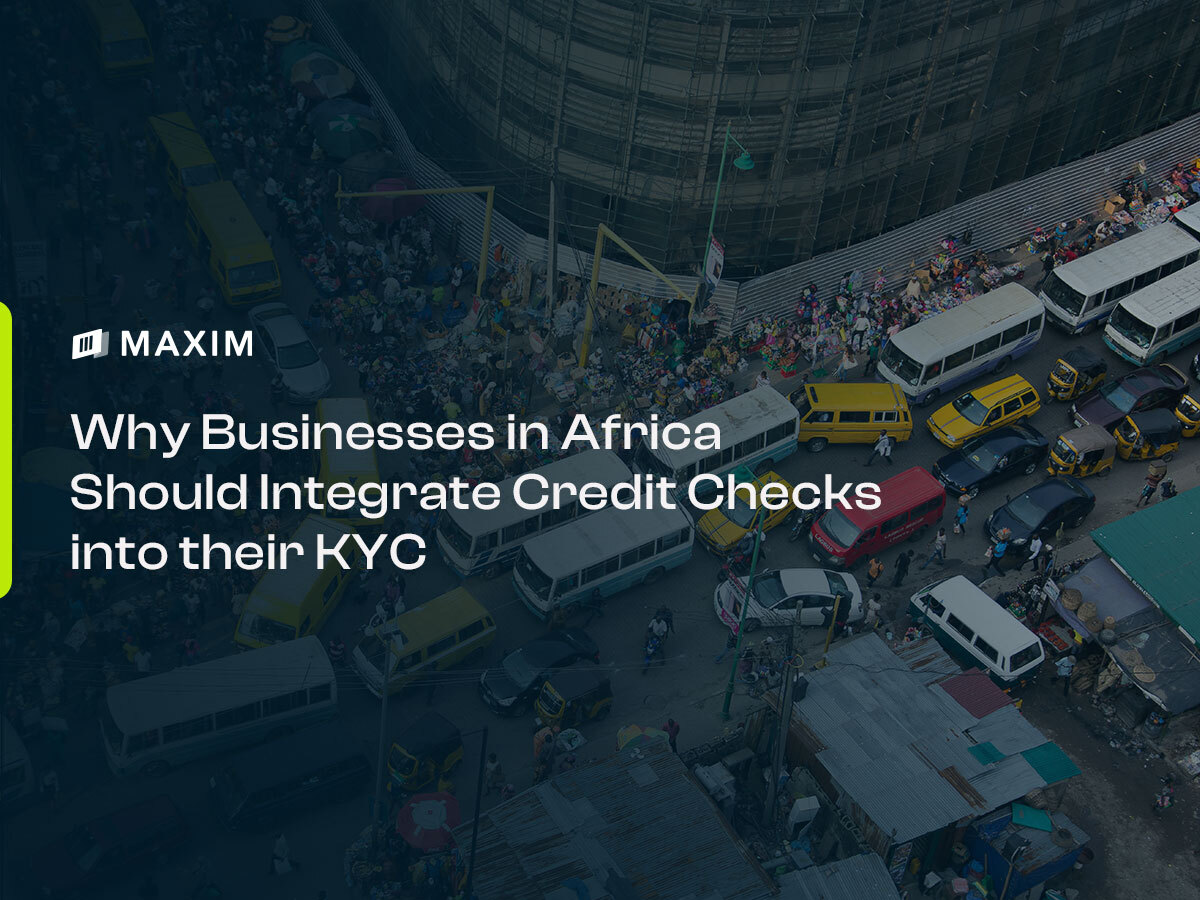

The Financial Future of Nigerians: Why MAXIM Is the Key

As Nigeria continues to evolve economically, financial access is crucial for personal and professional growth. The World Bank notes that less than 5% of Nigerians have access to formal credit, yet credit is one of the most important tools for financial independence and business growth.

MAXIM Credit Card aims to change this by offering an accessible, flexible, and rewarding financial solution to Nigerians who are ready to take control of their finances. By combining the best features of credit cards, like higher limits, flexibility, and credit-building benefits, MAXIM offers a path to financial empowerment.

Get Started with MAXIM Today

Getting your hands on a MAXIM Credit Card is simple.

- Apply for the Expense Card: Start building your credit and earn reward points from day one.

- Upgrade to MAXIM Credit Card: Gain higher limits and greater flexibility once you’ve built a financial foundation.

- Unlock Greater Financial Freedom: Use your MAXIM Credit Card to reach your financial goals, whether that’s funding your business, managing personal expenses, or improving your creditworthiness.

If you’re ready to go beyond the restrictions of loan apps and tap into the true flexibility that modern financial products offer, the MAXIM Credit Card is your ultimate solution. With higher credit limits, zero-low interest rates, and the ability to build your credit score, MAXIM helps you achieve your financial goals while giving you the freedom to manage your finances on your own terms.

Don’t settle for less. Experience financial flexibility like never before with MAXIM Credit Card.