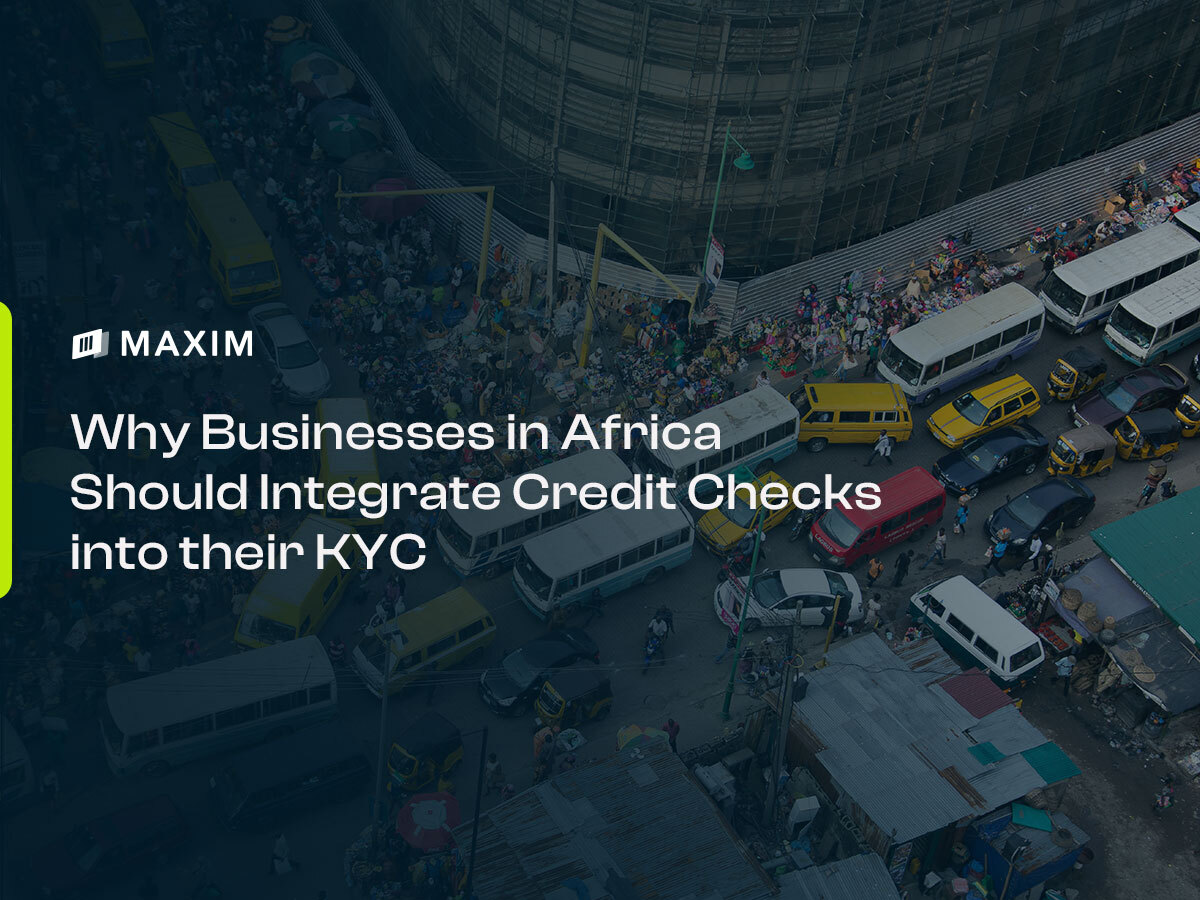

In Nigeria’s financial landscape, loans have become the go-to solution for immediate cash needs. But while loans may solve short-term problems, they often create long-term financial burdens. With skyrocketing interest rates, short repayment periods, and a lack of meaningful financial support, the traditional loan model is failing many Nigerians.

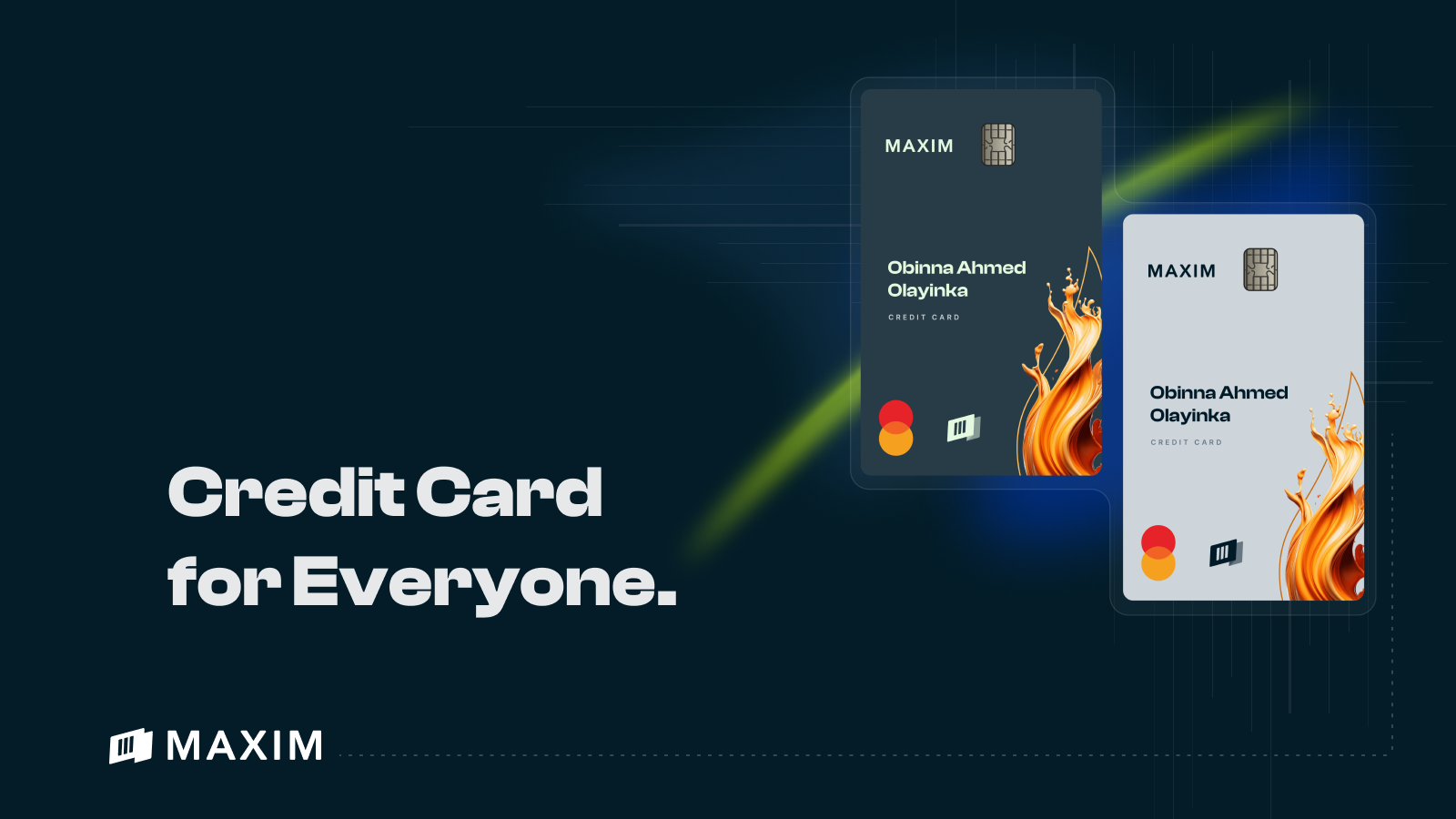

Enter MAXIM, a modern credit solution that shifts the focus from quick fixes to long-term financial growth. Unlike loans, MAXIM empowers you to thrive by building creditworthiness, enabling smarter financial habits, and unlocking better financial opportunities.

Real-Life Scenarios: How MAXIM Helps Nigerians Thrive

For Young Professionals

Ade, a 29-year-old software developer in Lagos, used to rely on loan apps for emergencies. High-interest rates left him struggling to break even every month. Switching to the MAXIM Credit Card allowed Ade to build his credit profile while enjoying lower interest rates and financial stability. Today, Ade has upgraded to MAXIM’s Premier membership, accessing higher credit limits and better financial perks.

For Small Business Owners

Ngozi, a boutique owner in Abuja, found herself stuck with unreliable loan options for managing inventory. With MAXIM, she now has a steady credit line, longer repayment terms, and the ability to plan her finances without stress. Her improved creditworthiness recently helped her secure a low-interest business loan.

The Data Doesn’t Lie

- Financial Exclusion: According to the World Bank, over 60% of Nigerians are unbanked or underbanked, limiting access to sustainable credit solutions.

- High Borrowing Costs: Nigerian loan apps rank among the highest globally in terms of interest rates, with borrowers paying up to 10% weekly interest on short-term loans.

- Credit Building in Africa: A 2023 study by EFInA highlighted that credit reporting in Nigeria is underdeveloped, with less than 15% of adults having a usable credit score.

MAXIM addresses these challenges by providing a credit solution that is both accessible and designed to build financial stability.

Why MAXIM is the Future of Financial Growth

Loans may solve immediate problems, but they don’t pave the way for long-term success. MAXIM is different. It combines credit access with tools for growth, ensuring you’re not just surviving but thriving.

Key Benefits of MAXIM:

- Affordable Credit: Zero-low interest rates make credit manageable.

- Long-Term Impact: Build your creditworthiness while enjoying financial freedom.

- Seamless Experience: No harassment, no reapplications—just easy, ongoing credit access.

- Empowerment Tools: Financial literacy resources and rewards keep you on the path to growth.

How to Get Started with MAXIM

Getting started with MAXIM is simple:

- Apply for the Expense Card: Begin your journey with the free MAXIM Expense Card, designed to help you build creditworthiness.

- Earn Points: Use your card for savings, spending, and referrals to accumulate points.

- Upgrade to the Credit Card: Once you’ve demonstrated financial responsibility, apply for the MAXIM Credit Card and enjoy higher credit limits and better perks.

The era of high-interest loans is over. With the MAXIM Credit Card, Nigerians can finally access credit that prioritizes their growth and financial well-being. Say goodbye to short-term fixes and hello to a smarter, more sustainable financial future.

Don’t just borrow—thrive with MAXIM. Apply today and take the first step toward true financial empowerment.