In Nigeria, millions of people are in search of a way to take control of their financial lives—whether it’s covering unexpected expenses, pursuing a dream, or just having more flexibility in day-to-day spending. For many, the answer lies in access to credit. But the traditional methods of borrowing, like loan apps or bank overdrafts, often come with hidden fees, high interest rates, and short repayment periods that leave you struggling instead of thriving.

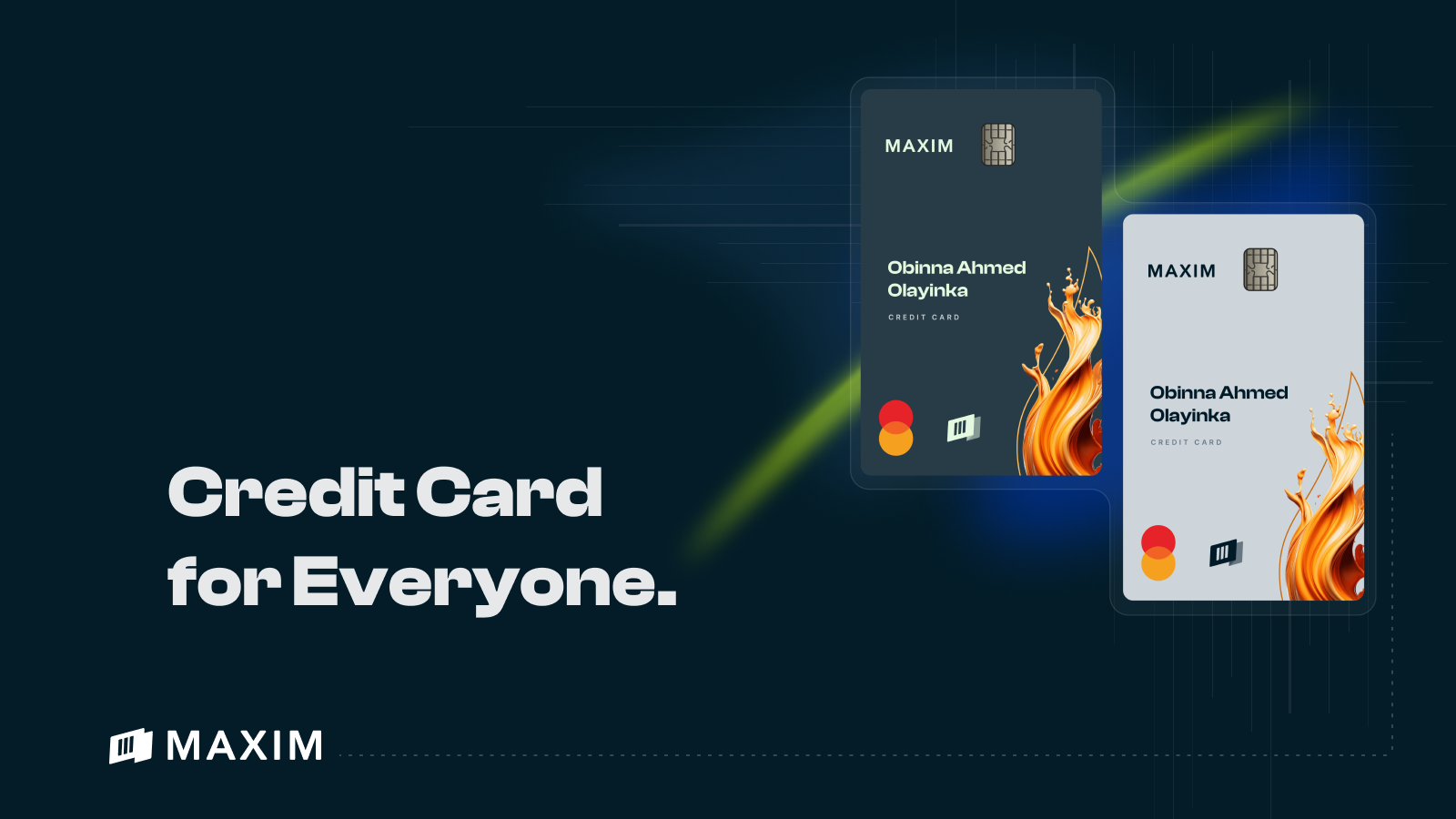

That’s where the MAXIM Credit Card steps in. If you’re tired of the endless cycle of loans, limited options, and high interest rates, MAXIM offers a revolutionary solution that puts your financial future back in your hands. With its instant approval process, low interest rates, and flexible terms, the MAXIM Credit Card is the fastest route to achieving financial freedom in Nigeria.

Why MAXIM Credit Card is a Game-Changer for Nigerians

1. Instant Approval—No Waiting, Just Action

Forget the lengthy approval processes and long waits that come with traditional loans. With the MAXIM Credit Card, you can receive instant approval, which means no more time wasted on back-and-forth communication with lenders. This fast, simple approval process ensures that you have access to the funds you need, when you need them, without all the usual delays.

Whether it’s an emergency expense or a planned purchase, the MAXIM Credit Card puts you in the driver’s seat, offering instant access to the credit you deserve.

2. Zero-Low Interest Rate (T&C Apply)—Keep More in Your Pocket

One of the most frustrating things about traditional loans and credit solutions is the sky-high interest rates that pile on debt quickly. With the MAXIM Credit Card, however, you don’t need to worry about getting stuck in a vicious cycle of debt. The zero-low interest rate (T&C apply) allows you to borrow at an affordable rate, so you can stay on top of your repayments without facing exorbitant fees.

By keeping your interest rates low, MAXIM ensures that you won’t be penalized with huge fees just for using your credit card. Your money goes further, and your financial freedom stays intact.

3. Flexible Repayment Terms—Take Control of Your Budget

Unlike loan apps, which typically demand quick repayment within a few weeks or months, the MAXIM Credit Card gives you flexible repayment options that work with your financial situation. Whether you’re looking to spread out payments over several months or pay off your balance faster, the flexibility of the MAXIM Credit Card ensures that you’re never locked into a rigid repayment schedule.

Having the freedom to choose how much you repay each month helps you manage your finances with less stress, allowing you to focus on what really matters: achieving your financial goals.

4. Build Your Credit Score—Invest in Your Future

While loan apps might help you in the short term, they don’t help build your long-term financial health. MAXIM Credit Card, on the other hand, allows you to build and improve your credit score over time. As you use your card responsibly—by making purchases, paying off your balance on time, and staying within your credit limit—you build a solid credit history.

A good credit score opens doors to future financial opportunities, such as larger loans, lower interest rates, and better credit terms. With MAXIM, you’re not just borrowing money; you’re investing in your future.

5. Rewards for Every Purchase—Earn While You Spend

Maximize the value of every naira you spend. The MAXIM Credit Card is designed to reward you for using your card responsibly. With every purchase, you earn rewards that could come in the form of cashback, discounts, or special offers.

These rewards help you save money while you’re spending, turning your everyday transactions into opportunities to earn something back. The more you use your card wisely, the more you benefit—making the MAXIM Credit Card not just a tool for spending, but a way to make your money work for you.

6. Security You Can Rely On

Security is paramount when it comes to managing your finances, and the MAXIM Credit Card offers state-of-the-art security features to protect your information. From fraud prevention to encrypted transactions, MAXIM ensures that your financial data is safe every time you use your card, so you can spend with peace of mind.

The Financial Freedom You Deserve

The MAXIM Credit Card is more than just a way to access credit—it’s a tool that empowers you to take control of your finances, make smarter decisions, and build a better future. Whether you’re looking to finance an important purchase, manage an emergency expense, or just have more flexibility in your day-to-day spending, the MAXIM Credit Card is here to help you unlock the financial freedom you deserve.

With its instant approval, low interest rates, flexible repayment terms, and rewards program, the MAXIM Credit Card is the smartest way to handle your finances in Nigeria. It’s time to stop relying on loans that only offer temporary relief and start building a better financial future with MAXIM.

Ready to take control of your financial future? Apply for the MAXIM Credit Card today and experience the fastest route to financial freedom.