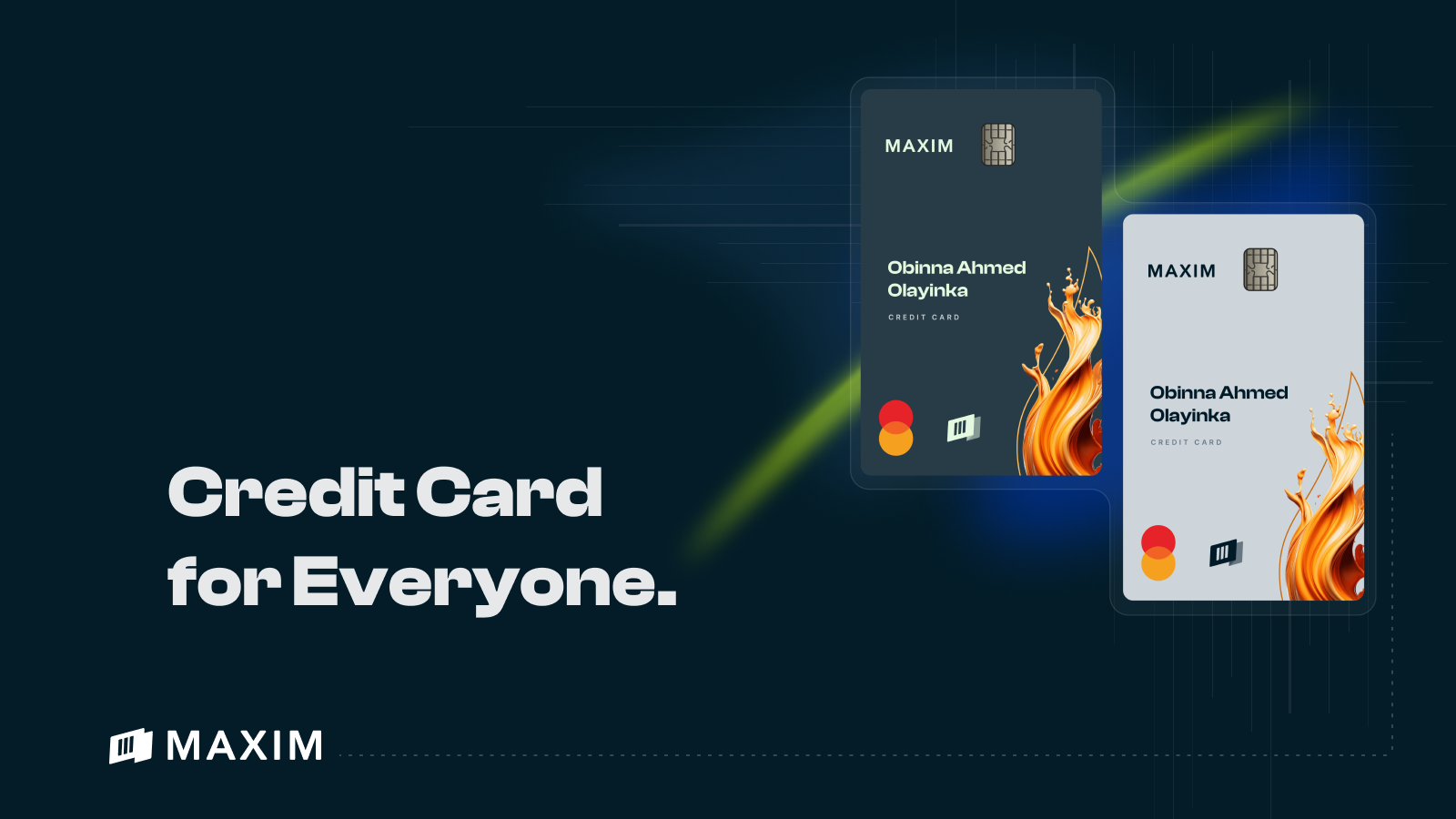

Monthly Membership fees: The Ultimate Guide to Maximizing Your MAXIM Card

At Maxim, we believe in keeping things stylish and straightforward, especially when it comes to understanding your monthly membership fees. Whether you’re eyeing that Premier card or dreaming of the elite Prestige tier, we’ve got the lowdown on what you’re paying for and why it’s worth it. Let’s dive into the details!

💳 MAXIM Card Tiers: A Quick Overview

Before we break down the fees, let’s review the MAXIM Card Tiers:

- Premier: The gateway to MAXIM’s world of benefits. Perfect for getting started.

- Elite: Step up your game with additional perks and a more refined experience.

- Signature: Enjoy VIP treatment and exclusive advantages.

- Prestige: The pinnacle of luxury and benefits, designed for those who want it all.

Each tier comes with its own set of features, perks, and—of course—monthly fees. Let’s see how these fees stack up.

🏷️ Monthly Membership Fees by Tier

1. Premier Card

The Premier Card is your entry ticket to the MAXIM experience. It’s budget-friendly while still offering a suite of benefits to get you started. This is the entry-level membership for all new users.

- Maximum credit limit: NGN 200,000 (Two hundred thousand Naira)

- Credit limit steps: Users start from any of the following 4 steps depending on their credit and financial record and then grow from there: –>NGN30,000, –> NGN50,000, –> NGN100,000, –> NGN200,000.

- Membership fees per month: Starts from NGN 1500

- One-Time Card Issuance Fee: NGN 2,150

- Card Type: Naira Only

- Level: Beginner Level

- Additional Charges: Limited to late fees and transaction fees, with minimal extra costs.

What You Get: Access to essential MAXIM benefits,

2. Elite Card

The Elite Card is designed for those who want a touch of extra sparkle in their financial life. It comes with enhanced features and more flexibility.

- Maximum credit limit: NGN 500,000 (Five hundred thousand Naira)

- Membership fees per month: Starts from NGN 10,000

- One-Time Card Issuance Fee: NGN 2,150

- Card Type: Naira Only

- Level: Intermediate Level – Unlocked only after maxing out premier membership

- Additional Charges: Includes lower late fees and more extensive transaction options.

What You Get: All the Premier benefits, plus exclusive offers on travel, dining, and entertainment. Elite cardholders also enjoy extended purchase protection and increased credit limits.

3. Signature Card

The Signature Card takes things up a notch with VIP treatment and top-notch perks. Ideal for frequent travelers and lifestyle aficionados.

- Maximum credit limit: NGN 5,000,000 (Five million Naira)

- Membership fees per month: Starts from NGN 35,000

- Card Type: NGN & USD

- Level: Advanced Level -Unlocked only after maxing out premier membership

- One-Time Card Issuance Fee: NGN 25,000

- Additional Charges: Reduced late fees, premium transaction services, and exclusive offers.

What You Get: Premium travel perks, enhanced concierge services, and access to luxury lifestyle experiences. This card is all about providing a top-tier financial experience.

4. Prestige Card

Welcome to the zenith of card luxury—the Prestige Card. For those who want it all, this card is the epitome of elite benefits and exclusivity.

- Maximum credit limit: $50,000

- Membership fees per month: Starts from USD 250

- Card Type: NGN & USD

- Level: Exclusive and strictly by invitation.

- One-Time Card Issuance Fee: NGN 200,000

- Additional Charges: Reduced late fees, premium transaction services, and exclusive offers.

What You Get: A world of luxury perks, including comprehensive travel insurance, access to exclusive lounges and hotels, and unparalleled concierge services. This card is designed to provide an extraordinary lifestyle experience.

🔍 Understanding What the Fees Cover

Monthly Membership Fees cover a range of benefits and services, ensuring you get maximum value from your MAXIM card. Here’s what the fees are paying for:

- Card Services: This includes the cost of maintaining your account, handling transactions, and providing customer support.

- Perks and Benefits: From travel insurance and concierge services to exclusive lifestyle benefits, your fees support the broad range of services available to you.

- Security: Your fees also contribute to maintaining high-security standards, fraud detection, and purchase protection.

💡 Tips for Maximizing Value

To get the most out of your MAXIM card and its monthly fees, keep these tips in mind:

- Use Your Perks: Make sure to take advantage of all the benefits and offers available with your card. Whether it’s dining discounts or travel insurance, they’re part of what you’re paying for!

- Stay Within Your Budget: Choose a card that aligns with your spending habits and financial goals. Don’t pay for perks you won’t use.

- Monitor Your Spending: Use the MAXIM app to track your expenses and make sure you’re using your card wisely.