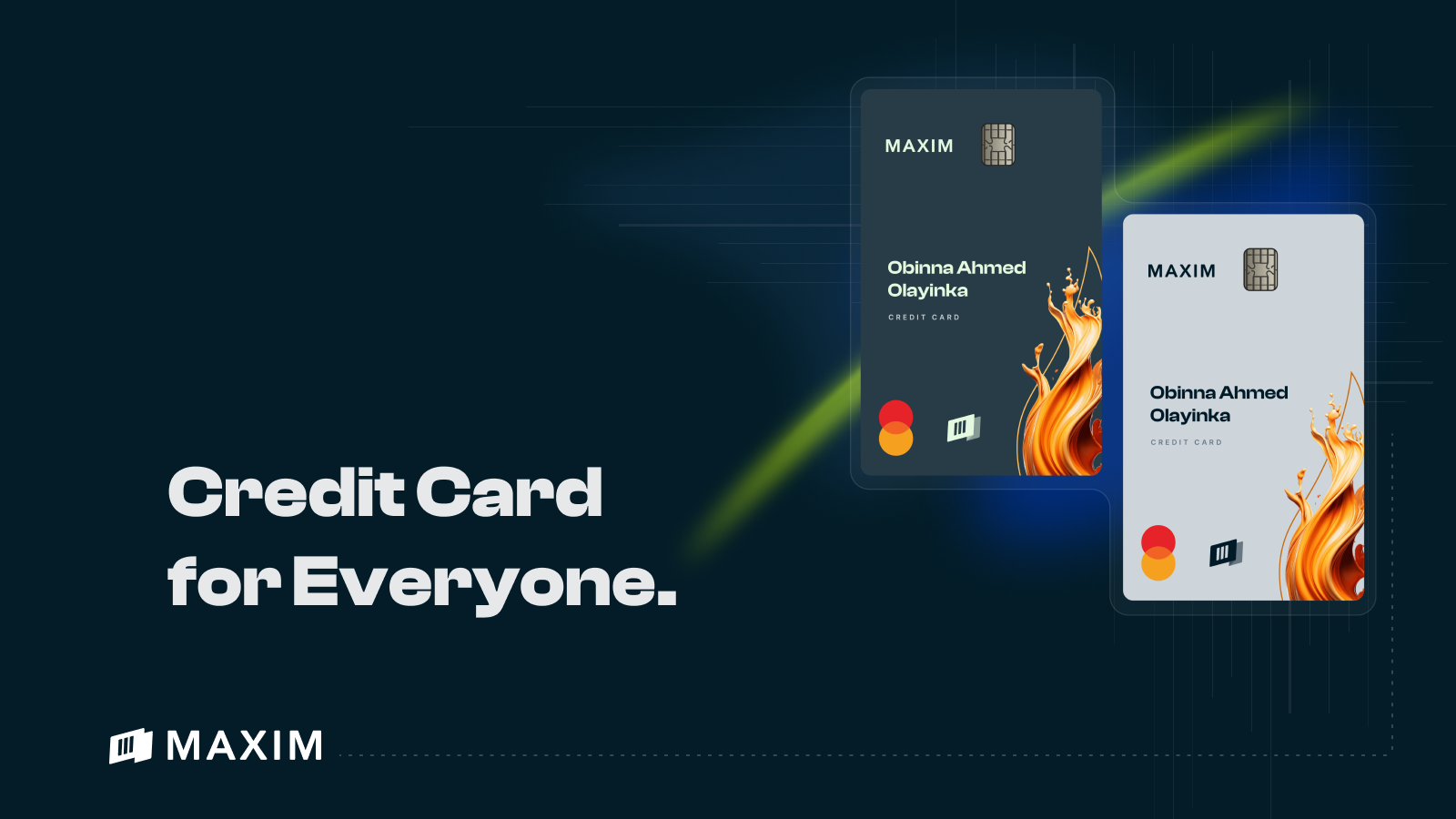

Loan Apps vs. MAXIM Credit Card: Reimagining Credit for a New Generation of Nigerians.

In a world where convenience is king and financial needs can arise at any moment, Nigerians have turned to digital solutions for quick credit access. Over the last few years, loan apps have emerged as the go-to option for anyone needing fast cash—no paperwork, no waiting, and no collateral. But as digital credit evolves, it’s clear that the future of financial freedom isn’t in short-term loans. The new wave of financial solutions comes from MAXIM Credit Card, a smarter, more sustainable approach to managing your money.

In this article, we’ll dive into why the MAXIM Credit Card is not just an alternative to loan apps but a complete reimagining of what access to credit can be in Nigeria.

Credit in the Age of Instant Gratification: The Problem with Loan Apps

Loan apps have revolutionized credit access in Nigeria by providing instant loans with minimal requirements. However, quick cash comes at a cost. For every loan taken, users are often trapped in a cycle of repayment due to the app’s high interest rates and short repayment terms. These apps are transactional—designed for immediate relief, not long-term financial stability.

But Here’s the Issue: The Long-Term Cost of Quick Loans

It’s easy to get swept up in the appeal of an instant loan. After all, who wouldn’t want access to cash when life throws a curveball? However, these loan apps often leave Nigerians with more problems than solutions. Here are some key issues that often get swept under the rug:

- High interest rates: Loan apps often charge sky-high interest rates—sometimes up to 40% annually. The longer you take to repay, the more you end up paying.

- Rigid repayment cycles: With repayment periods as short as 7–30 days, many users struggle to pay back the loan on time, triggering penalties and late fees.

- Limited financial flexibility: Loan apps tend to focus on offering quick fixes for immediate needs, but they don’t provide much room for managing long-term financial goals.

- Re-application process: Every time you need credit, you’re forced to reapply for a new loan—often at a higher rate and with the same stressful process.

This constant cycle of borrowing and repaying puts users in a precarious financial situation, as it’s hard to break free from the pressure of short-term borrowing.

MAXIM Credit Card: A Smarter Solution to Credit

While loan apps focus on short-term financial relief, MAXIM Credit Card offers a new way of thinking about credit: one that empowers Nigerians to take control of their financial future. MAXIM is not here to replace loan apps, but to redefine how Nigerians approach credit. Here’s why:

1. Low, Transparent Interest Rates

MAXIM Credit Card offers zero-low interest rates (T&C apply), far lower than most loan apps, which often trap users with astronomical fees. By using a MAXIM Credit Card, users can make purchases or pay for emergencies without worrying about being crushed by high interest.

2. Build Your Credit, Not Your Debt

While loan apps only offer quick fixes, MAXIM Credit Card encourages long-term financial growth. By using your card responsibly, making timely payments, and building a strong credit history, users can improve their creditworthiness. This is a long-term investment in your financial health, unlike loan apps that leave you paying high interest rates without building any kind of lasting credit score.

3. Flexibility & Control Over Repayments

Gone are the days of scrambling to meet a loan deadline. With MAXIM Credit Card, users have greater flexibility in managing their repayments. Instead of being locked into a rigid repayment schedule, you can repay the credit balance in a way that works for your budget and timeline. Whether you prefer to pay it off in full or over a few months, MAXIM allows for greater financial control.

4. Instant Credit Without the Hassle

Unlike loan apps, which often involve multiple steps of documentation and verification, MAXIM Credit Card offers instant approval once the eligibility criteria are met. In a matter of minutes, you can access the funds you need without delays or unnecessary paperwork. No more waiting for days to get credit approval—MAXIM gets you the credit you need, fast.

5. Rewards, Cashback, and Financial Benefits

What sets MAXIM Credit Card apart from loan apps is the added value it offers. With MAXIM, you’re not just borrowing money—you’re earning rewards. Each transaction with the card comes with cashback and points that you can use for discounts, special offers, or even transfer into savings. These benefits turn everyday spending into opportunities to save and earn, making your credit card work for you instead of the other way around.

6. A Pathway to Financial Independence

Instead of falling into a cycle of borrowing to pay back previous loans, the MAXIM Credit Card helps you pave the way toward financial independence. By offering a structured credit option with low interest rates, flexible repayments, and rewards, MAXIM makes it easier to take control of your financial future. It’s about more than just quick cash—it’s about building wealth over time.

Why the Future is Maxim Credit Cards, Not Loans

Loan apps have become a quick fix in the digital era, but they are not designed to help users build wealth or long-term financial stability. MAXIM Credit Card, on the other hand, provides an opportunity for financial growth and empowerment. It’s not just a tool for borrowing money—it’s a financial product that grows with you, helps you manage your expenses, and enables you to build your credit history.

The future of credit in Nigeria is no longer about borrowing from one app to pay another. It’s about access to long-term, flexible credit that supports your growth, with the MAXIM Credit Card leading the way.