Leave Loans in the Past: Discover MAXIM’s Smarter Credit Solutions.

In recent years, loan apps have become the go-to option for many Nigerians in need of quick cash. These apps promise fast access to funds, but at what cost? High-interest rates, short repayment periods, and the constant cycle of reapplication have left many users stuck in a financial rut. But what if there was a better, smarter alternative—one that didn’t just offer temporary relief but provided a sustainable way to manage your finances? Enter MAXIM, the game-changing credit solution that is revolutionizing how Nigerians access credit. Forget loans—MAXIM offers a path to long-term financial health and independence.

The Downside of Loan Apps in Nigeria

While loan apps have gained popularity in Nigeria, they come with a host of challenges that make them less than ideal for anyone looking for long-term financial stability:

- Exorbitant Interest Rates: Loan apps often charge outrageously high-interest rates, leaving borrowers with an overwhelming debt burden. With interest rates that can go as high as 100%, borrowers find themselves repaying far more than they initially borrowed, making it difficult to break free from the cycle of debt.

- Reapplication Every Time: If you need money, you’re forced to reapply each time. This means filling out forms, providing personal details, and waiting for approval—only for the loan to be approved with strict terms and short repayment timelines. This process is not only tedious but creates unnecessary stress when money is needed urgently.

- Short-Term Solutions with No Long-Term Benefits: Loan apps are designed to solve short-term financial problems. However, they don’t help users build long-term credit or financial health. Without a focus on improving your credit score, users find themselves in a constant borrowing loop, never really achieving financial independence.

- No Support for Financial Growth: Most loan apps are transactional in nature, meaning they provide funds without any educational support or tools to help you improve your financial health. This leaves users with little room to grow their savings or improve their financial literacy.

MAXIM: The Smarter Way to Access Credit

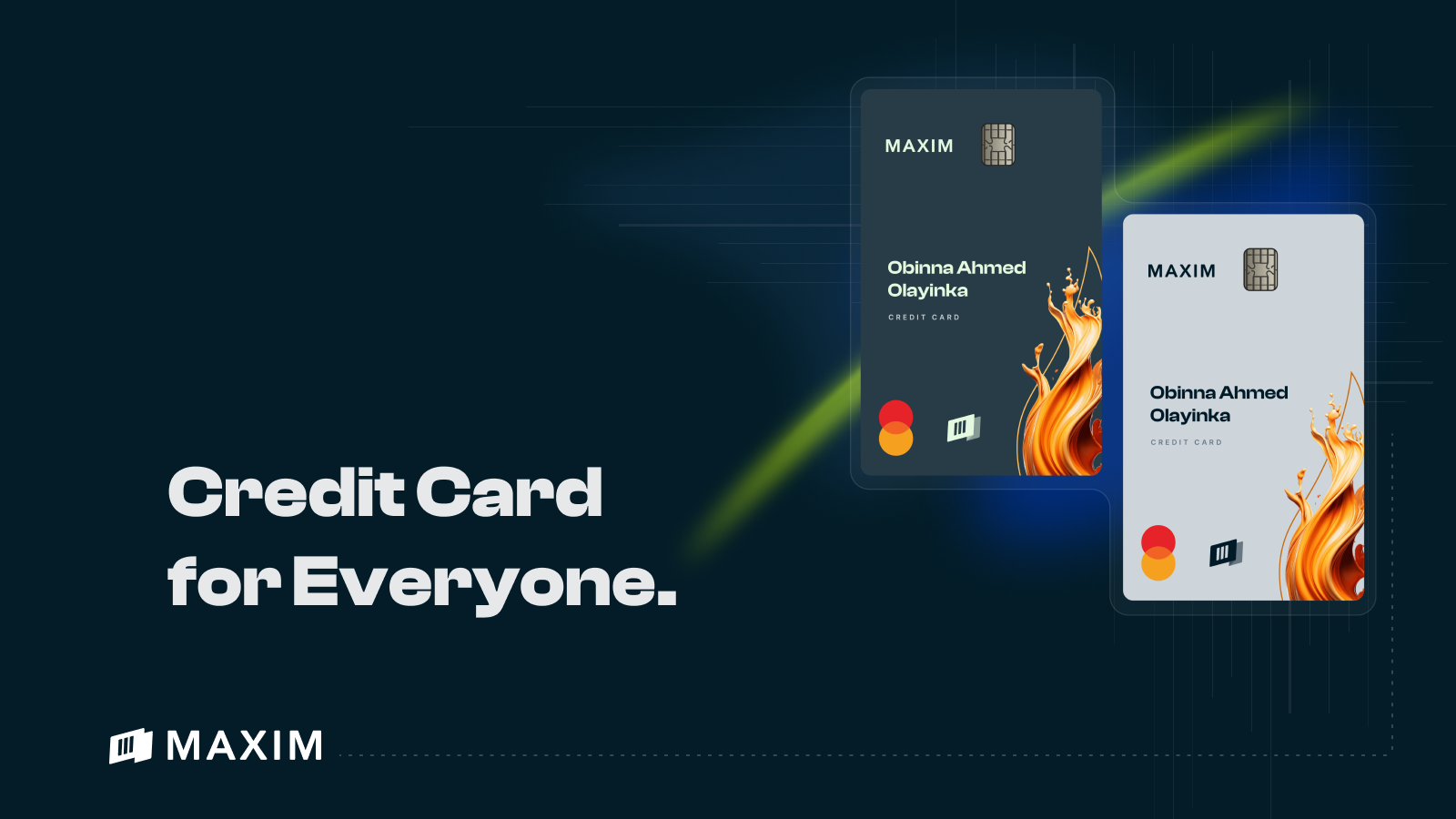

While loan apps continue to dominate the financial landscape, MAXIM is here to provide a smarter and more sustainable solution to credit. Rather than just offering another loan product, MAXIM has created a credit card designed to improve your financial well-being, help you build credit, and ensure you have access to funds when you need them—without the pitfalls of loan apps.

1. Build Credit Over Time

One of the biggest advantages of the MAXIM Credit Card is its ability to help users build credit over time. Unlike loan apps, which often do not report to credit bureaus or help you establish a credit history, MAXIM allows you to boost your credit score with every responsible payment you make. Over time, this can open doors to more favorable credit options, lower interest rates, and even larger loans with better terms.

2. Affordable and Transparent Rates

Unlike loan apps, which often come with hidden fees and high-interest rates, MAXIM Credit Card offers affordable and transparent interest rates. MAXIM believes that credit should be accessible without the burden of unmanageable repayments. With MAXIM, you’ll know exactly what you’re paying and when, giving you the freedom to plan and manage your finances better.

3. No Reapplication Needed

Gone are the days of reapplying every time you need credit. With the MAXIM Credit Card, you can access credit whenever you need it without having to fill out forms or wait for approval. Whether it’s for an emergency, shopping, or even a large purchase, your MAXIM card gives you continuous access to credit. Over time, as you build your creditworthiness, your limit can also increase—making it even easier to manage larger expenses.

4. Flexible Repayment Terms

MAXIM understands that everyone’s financial situation is different. That’s why the MAXIM Credit Card offers flexible repayment terms that allow you to manage your finances in a way that works for you. You can make payments at your own pace, and over time, you’ll gradually pay off your balance without the pressure of short-term repayment timelines. This flexibility gives you more control over your financial health and keeps you from falling into the cycle of borrowing from one app to pay off another.

5. Exclusive Benefits and Rewards

But it’s not just about access to credit—MAXIM Credit Card offers a range of exclusive benefits and rewards for its users. From cashback deals to discounts at your favorite stores, MAXIM is designed to help you get more out of your everyday spending. With the points you accumulate, you can unlock additional benefits, ensuring that every purchase brings you closer to a better financial future.

6. A Path to Financial Health

Perhaps the most important difference between loan apps and MAXIM is that MAXIM is committed to your long-term financial health. With features like spending tracking, educational resources, and tips on how to manage your finances, MAXIM empowers you to not just use credit but to learn how to use it responsibly. This sets you on a path to financial stability, unlike loan apps that are more focused on quick, one-off transactions.

Why MAXIM is the Future of Credit in Nigeria

MAXIM is not just an improvement on loan apps—it’s an entirely new way of thinking about credit. It’s about empowering users to take control of their financial lives, build long-term credit, and gain access to sustainable financial products that work for them. The MAXIM Credit Card isn’t just another quick fix—it’s an opportunity to build a brighter financial future without the stress and risk of traditional loan apps.

With affordable interest rates, flexible repayment terms, and a focus on credit building, MAXIM is redefining what it means to access credit in Nigeria. It’s time to stop relying on short-term loan apps and start building your financial future with MAXIM.

Ready to leave loans behind? Discover MAXIM’s smarter credit solutions today.