Go Beyond Loan Limits with MAXIM Credit Card’s Higher Spending Power

For many Nigerians, financial empowerment has always been tied to borrowing from traditional banks, fintech loan apps, or even informal lending sources. While these avenues can provide short-term solutions, they often come with restrictive limits, high-interest rates, and an overall lack of flexibility.

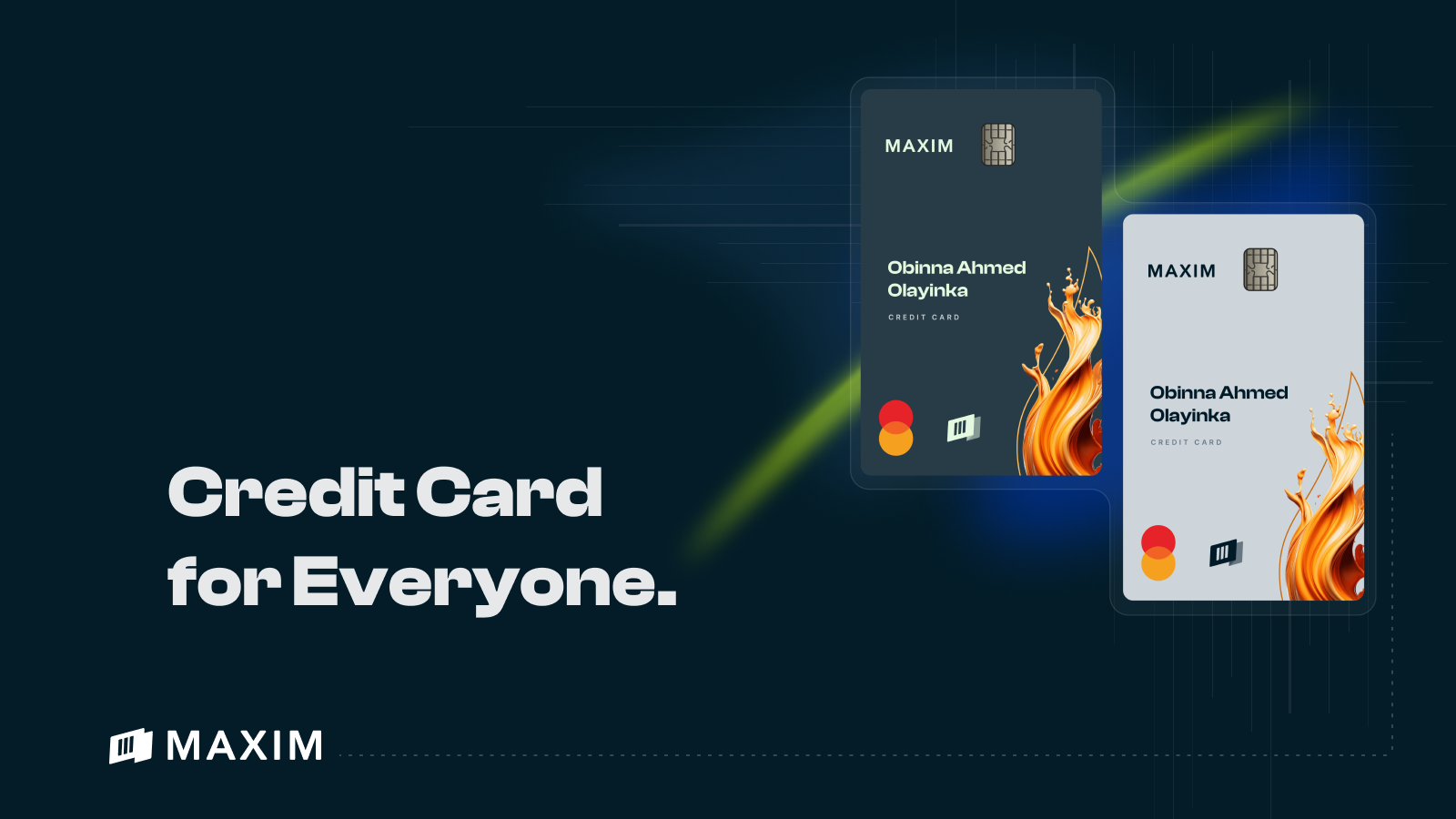

What if you could break free from these constraints and access a financial tool that not only gives you spending power but also sets you on the path to long-term financial growth? Enter the MAXIM Credit Card, a revolutionary product redefining credit in Nigeria.

The Problem with Loans: A Short-Term Fix with Long-Term Costs

Loan apps have made borrowing more accessible, but they come with significant downsides:

- Low Borrowing Limits: Many loan apps cap limits at just ₦50,000–₦100,000, barely enough to cover significant expenses.

- High-Interest Rates: Rates often range from 30% to 120% annually, leaving borrowers in a debt cycle.

- Reapplication Stress: Each time you need funds, you must reapply, with no guarantee of approval.

- No Financial Growth: Borrowing from loan apps doesn’t build creditworthiness or contribute to financial stability.

These limitations make it clear: Nigerians need more than loans. They need a tool that provides higher spending power, flexibility, and growth opportunities.

MAXIM Credit Card: Redefining Financial Access

The MAXIM Credit Card is designed to solve these problems by offering something loan apps can’t—a powerful financial solution with long-term benefits. With MAXIM, you’re not just borrowing; you’re unlocking spending power and paving the way to financial independence.

Key Features of MAXIM Credit Card

1. Higher Credit Limits

Loan apps might offer quick cash, but their limits often fall short for larger expenses like tuition, medical bills, or business investments. MAXIM Credit Card provides higher credit limits, giving you the flexibility to fund bigger goals without multiple reapplications.

2. Zero-Low Interest Rates

Say goodbye to crippling interest rates. MAXIM offers zero-low interest rates (T&Cs apply), ensuring that you borrow responsibly and affordably.

3. Revolving Credit Line

Unlike loans that require reapplication every time, the MAXIM Credit Card offers a revolving credit line. This means once approved, you can access funds anytime within your limit, making it perfect for recurring or unexpected expenses.

4. Credit-Building Benefits

Every swipe helps you build your credit score, which is crucial for accessing larger financial opportunities like mortgages, car loans, or business funding. According to EFInA’s Financial Access Survey, only 4% of Nigerians currently use credit cards, but MAXIM is set to change that by making credit-building accessible to all.

5. Reward Points for Everyday Spending

With MAXIM, your transactions turn into rewards. Points earned from card usage can be redeemed for perks or used to upgrade your credit limit, creating a win-win scenario for responsible spending.

The Nigerian Financial Landscape: Why Higher Spending Power Matters

Underdeveloped Credit Ecosystem

In Nigeria, formal credit systems remain underutilized. According to Statista, only 2% of Nigerians have access to a credit card, compared to 70% of Americans. This lack of access limits financial opportunities and keeps many stuck in short-term borrowing cycles.

High Cost of Loan Apps

A recent survey by the Guardian Nigeria revealed that over 60% of loan app users struggle with repayment due to high-interest rates and unrealistic repayment schedules. MAXIM’s affordable and flexible approach addresses this pain point.

Empowering Business Owners

Small businesses in Nigeria often face funding gaps, with only 5% of SMEs having access to formal credit, according to the World Bank. The MAXIM Credit Card’s higher limits and tailored financial tools empower entrepreneurs to scale their ventures without the constraints of traditional loans.

Real-Life Scenarios Where MAXIM Outshines Loan Apps

Scenario 1: Funding a Business Expansion

Temi, an online retailer in Lagos, needed ₦200,000 to purchase bulk inventory for the holiday season. Loan apps capped her borrowing at ₦50,000, leaving her to scramble for alternatives. With MAXIM Credit Card, Temi accessed the full amount she needed, repaid affordably, and earned reward points in the process.

Scenario 2: Managing Recurring Expenses

Chioma, a young professional in Abuja, used loan apps to cover monthly bills but found the constant reapplication process stressful. With MAXIM’s revolving credit line, Chioma now manages her recurring expenses with ease and builds her credit score simultaneously.

The MAXIM Advantage: Why It’s More Than Just a Credit Card

MAXIM isn’t just about borrowing; it’s about empowering users to take control of their finances. Here’s how it stacks up against loan apps:

Join the MAXIM Revolution

Getting started with MAXIM is simple:

- Apply for the Expense Card: Build financial habits and earn points.

- Upgrade to MAXIM Credit Card: Access higher credit limits and rewards.

- Unlock Growth Opportunities: Use your credit card to achieve personal and professional goals while building your financial future.

Loan apps might work for quick fixes, but they’re no match for the higher spending power, flexibility, and long-term benefits of the MAXIM Credit Card. Whether you’re a professional managing monthly expenses or a business owner scaling operations, MAXIM gives you the tools to thrive financially.

Why settle for less? Go beyond the limits of loans with MAXIM Credit Card and take charge of your financial journey today!