Forget Loans: How MAXIM Credit Card Offers a Better Financial Path.

The Nigerian financial landscape is evolving, with new fintech solutions emerging to meet the growing demand for access to credit. However, despite the influx of loan apps, many people still find themselves struggling with high interest rates, short repayment terms, and limited opportunities for long-term financial growth. Enter MAXIM—a game-changing alternative to the traditional loan app culture. MAXIM is offering a fresh and innovative approach to credit access with the MAXIM Credit Card, designed to give Nigerians a better financial future without the debt traps and stress associated with typical loan apps.

The Loan App Trap: Quick Fixes with Long-Term Consequences

Loan apps in Nigeria have gained massive popularity in recent years, offering quick and easy access to cash. These platforms promise immediate relief for everything from medical bills to unexpected expenses. But, in reality, loan apps often create a vicious cycle that’s hard to escape.

Here’s why:

- Exorbitant Interest Rates: Loan apps frequently charge interest rates that make it hard for borrowers to repay their loans without falling further into debt. Rates can often exceed 100% annually, leaving borrowers with crippling debt.

- Aggressive Collection Tactics: Many loan apps engage in aggressive and unethical practices, including harassment, threats, and even public shaming of borrowers. This can add emotional stress on top of the financial strain.

- Limited Borrowing Opportunities: Each time you need money, you have to reapply for a loan. This transactional approach doesn’t build your credit score or improve your financial standing in the long run. It only keeps you in a cycle of borrowing.

- No Focus on Building Financial Health: Loan apps don’t help you build a sustainable financial future. They offer short-term loans, but they don’t help you improve your credit score or teach you how to manage money wisely.

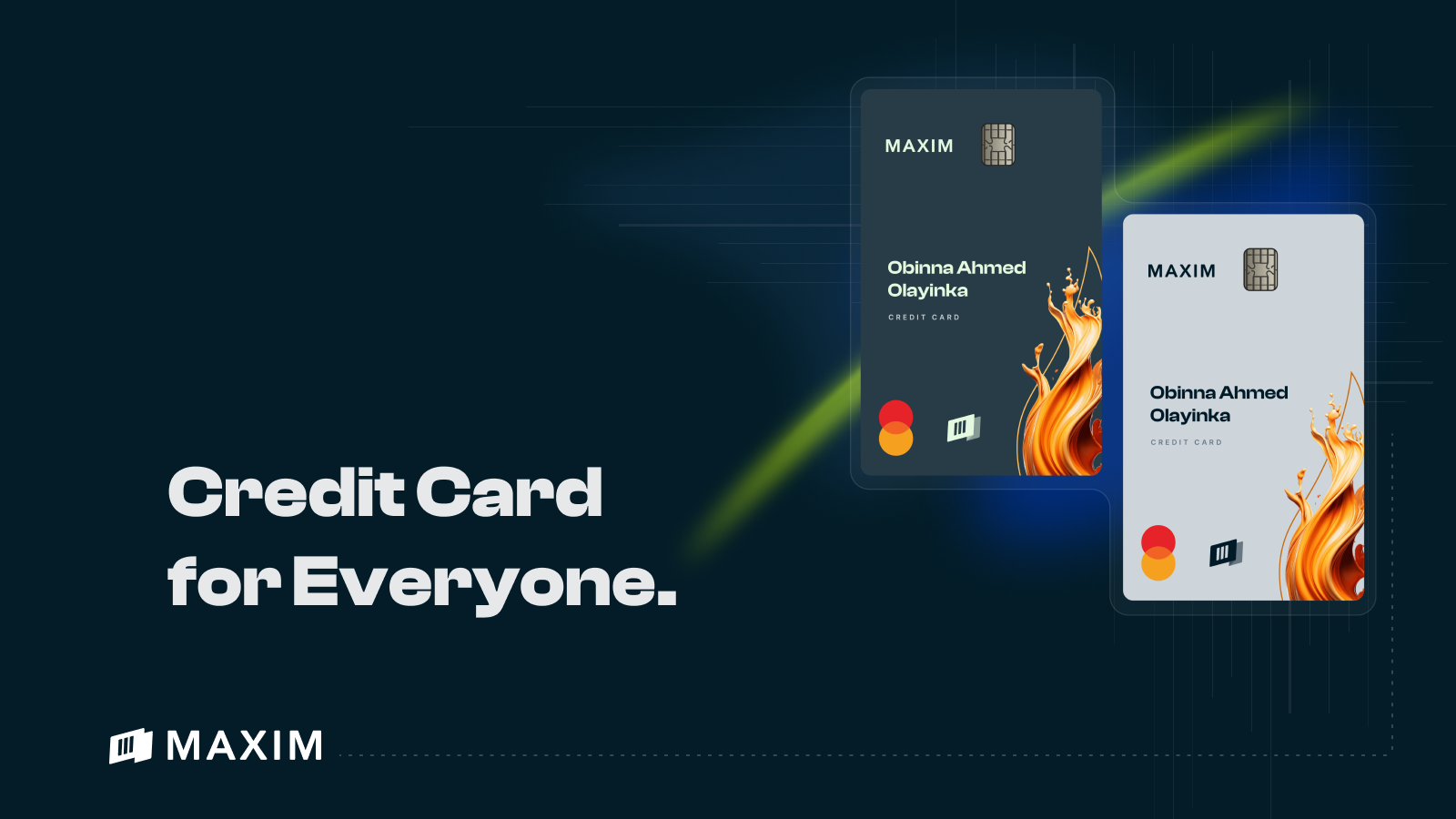

MAXIM Credit Card: The Smart Financial Alternative

In contrast to the loan app model, the MAXIM Credit Card is a breath of fresh air for Nigerians who want to build a solid financial foundation. MAXIM is more than just another credit card—it’s a new opportunity to gain financial independence while building a healthy credit history.

Here’s why the MAXIM Credit Card is a better financial path:

1. Build Credit, Not Debt

Unlike loan apps, which focus on quick, short-term fixes, the MAXIM Credit Card is designed to help you build a positive credit history over time. By using your card responsibly, you’ll have the opportunity to increase your credit score, opening doors for future financial opportunities, like personal loans or higher credit limits.

Building credit with MAXIM means you’re investing in your financial future—not just borrowing money to get by.

2. Low and Transparent Interest Rates

MAXIM understands that financial freedom comes from transparency and fairness. That’s why we offer competitive interest rates—much lower than those offered by typical loan apps. We want you to borrow with confidence, knowing that your repayments will be manageable, and you won’t get trapped by sky-high interest rates.

Additionally, there are no hidden fees or surprise charges. You’ll always know exactly what you owe.

3. Flexible Payment Terms

One of the biggest pain points with loan apps is the short repayment terms, which can put a huge strain on your finances. MAXIM offers more flexible repayment plans, giving you the time and space to pay back what you owe without stressing over tight deadlines. This means you can manage your finances better and avoid falling behind on repayments.

4. Access to Larger Credit Limits

Instead of being limited to small, short-term loans, the MAXIM Credit Card offers higher credit limits based on your financial profile and repayment history. This means you can use your card for bigger purchases, travel, or emergencies without having to apply for multiple loans every time you need access to credit.

5. Rewards and Benefits

MAXIM doesn’t just give you credit—it rewards you for using it wisely. As a cardholder, you can earn reward points on every purchase, which can be redeemed for exclusive benefits. Whether it’s discounts, special offers, or cashback, the MAXIM Credit Card allows you to make the most of your spending.

6. No Reapplication Required

Unlike loan apps that require you to reapply for every loan, the MAXIM Credit Card gives you continuous access to credit. As long as you manage your account responsibly, your credit line grows automatically, without the need to reapply or go through lengthy approval processes every time you need credit.

7. Secure, Safe, and Convenient

MAXIM prioritizes the safety of your financial data. With advanced security features, you can rest assured that your personal information is well protected. Additionally, our mobile app allows you to manage your credit card account from anywhere, track your spending, and make payments conveniently.

MAXIM Credit Card vs. Loan Apps: The Clear Winner

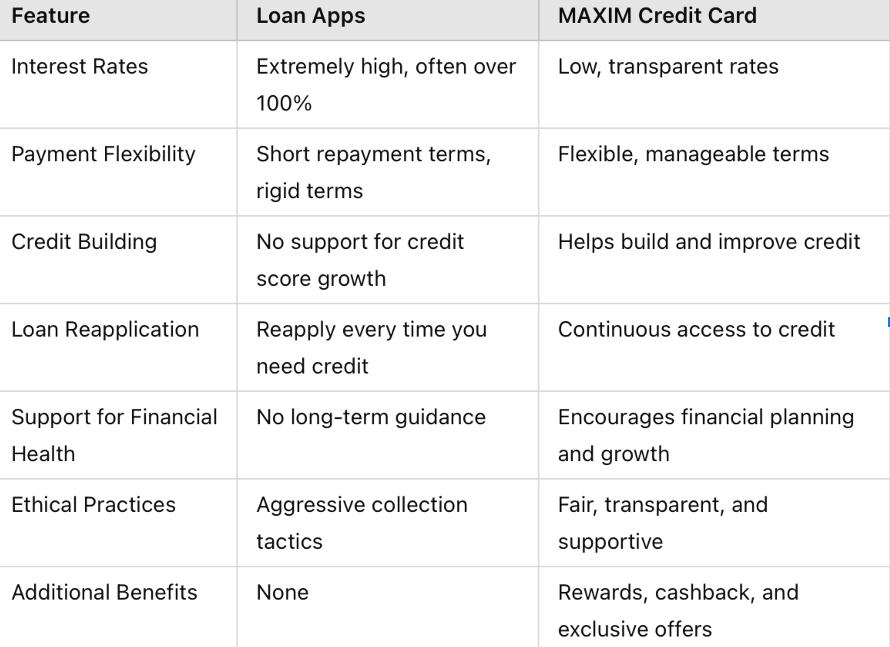

While loan apps may seem like a quick solution for financial emergencies, they don’t provide the long-term benefits and financial growth that the MAXIM Credit Card offers. Here’s a side-by-side comparison:

Clearly, the MAXIM Credit Card provides a far more sustainable, transparent, and rewarding solution to credit access. Instead of locking you into a cycle of borrowing and repaying short-term loans, MAXIM gives you the tools to build your financial future with ease.

Why MAXIM is the Game-Changer in Nigeria’s Credit Market

MAXIM isn’t just another credit product—it’s a new opportunity for Nigerians who are ready to take control of their financial futures. By offering a product that builds credit, encourages responsible spending, and rewards long-term financial health, MAXIM is redefining what credit can do for you.

Gone are the days of relying on loan apps that trap you in debt. With MAXIM, you can unlock a world of financial freedom, while enjoying the flexibility and security of a credit product that supports your financial goals.

Ready to Make the Switch?

If you’re tired of the loan app cycle and want a credit card that works for you, it’s time to make the switch to MAXIM. Apply today and start building a brighter, financially secure tomorrow. With MAXIM, the path to financial growth and independence is just a few clicks away.