For Nigerians Who Want More: MAXIM Credit Card’s Unmatched Flexibility.

In a fast-paced world where financial needs are as dynamic as ever, traditional loans and rigid credit systems often leave Nigerians wanting more. Loan apps provide quick fixes, but they come with limitations—high interest rates, low limits, and little room for financial growth. Enter the MAXIM Credit Card, a financial tool designed with modern Nigerians in mind, offering the flexibility to keep up with your ambitions and lifestyle.

The Problem with Traditional Loan Options

Rigid Loan Structures

Loan apps and traditional credit options often operate with predefined terms—fixed repayment schedules, unchanging interest rates, and minimal flexibility. This approach doesn’t cater to dynamic needs like fluctuating monthly expenses or emergencies.

Lack of Growth Opportunities

Using loan apps repeatedly can trap users in a cycle of borrowing without helping them achieve financial stability. According to EFInA, Nigeria’s financial inclusion rate rose to 64% in 2022, but access to meaningful credit options that encourage financial growth remains limited.

Sky-High Interest Rates

Loan apps frequently charge interest rates ranging from 30% to 120% annually, leaving borrowers paying back significantly more than they borrowed. With such rates, the cost of accessing funds outweighs the benefits.

Clearly, Nigerians need more than just loans—they need financial flexibility that adapts to their goals and circumstances.

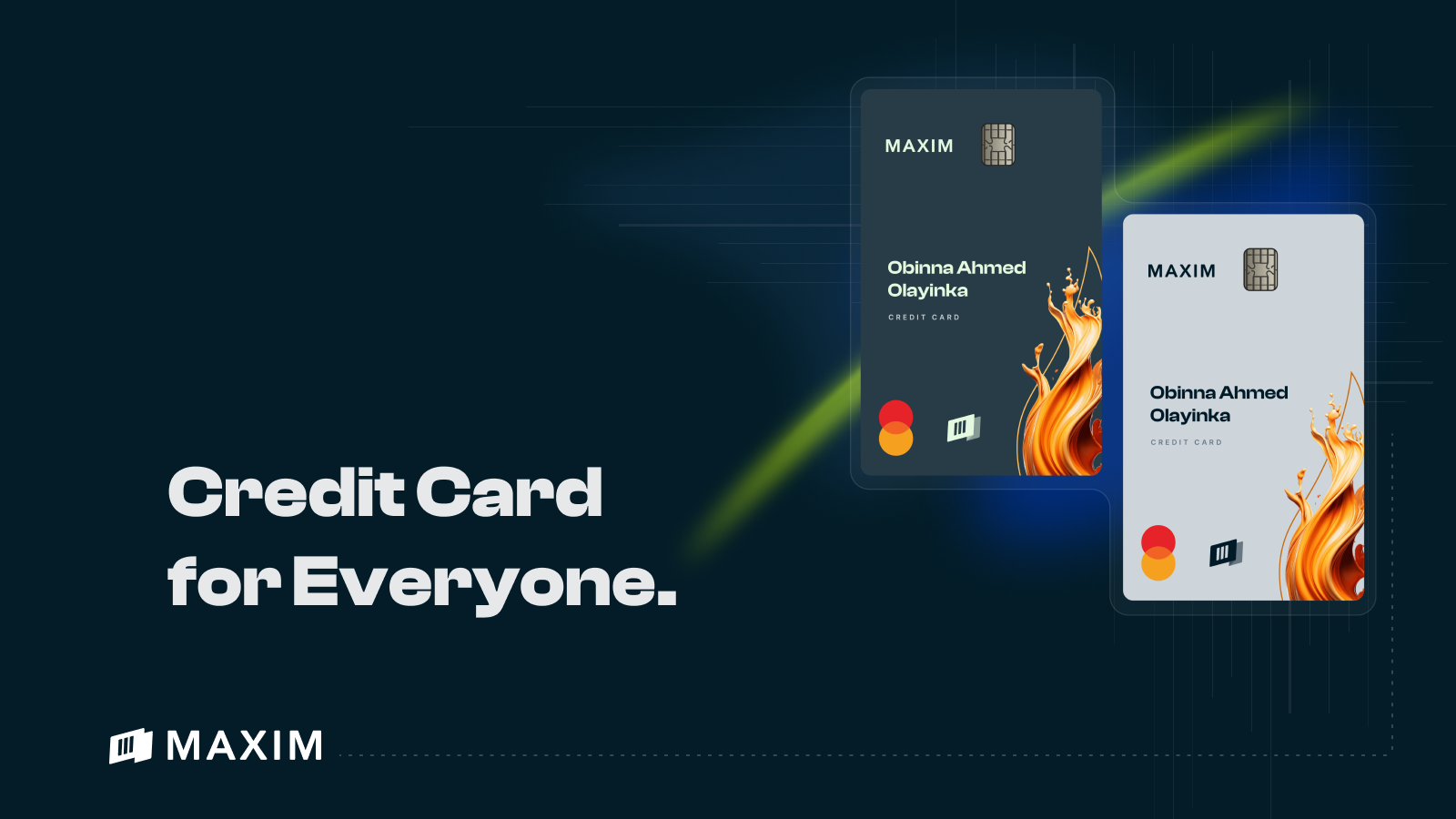

What Makes MAXIM Credit Card Different?

The MAXIM Credit Card is not just another financial product; it’s a tool for financial empowerment. Designed to meet the unique needs of Nigerians, MAXIM prioritizes flexibility, affordability, and long-term growth.

1. Flexibility That Fits Your Life

Whether it’s an unexpected car repair, a dream vacation, or expanding your business, MAXIM adapts to your financial needs. Unlike loans that require frequent reapplications, the MAXIM Credit Card offers a revolving credit line, so you always have access to funds when you need them.

2. Zero-Low Interest Rates

Why pay excessive interest for short-term loans? MAXIM provides a zero-low interest rate option (T&Cs apply), ensuring your borrowing costs remain manageable.

3. Customizable Credit Limits

With loan apps, you’re often restricted to borrowing limits that don’t reflect your true financial capacity. MAXIM assesses your needs and creditworthiness to offer higher, more personalized limits that grow with you over time.

4. Build Credit While Spending

Every transaction with MAXIM helps you build your credit profile. According to Statista, only 2% of Nigerians currently have credit cards. By expanding this access, MAXIM is helping to create a culture of responsible borrowing and financial growth.

5. Rewards That Work for You

With MAXIM, every swipe earns points that can be redeemed for perks or used to enhance your credit limit. It’s not just about borrowing; it’s about rewarding responsible financial behavior.

The Nigerian Perspective: Why Flexibility Matters

Unpredictable Financial Needs

From monthly bills to sudden emergencies, Nigerians face fluctuating financial demands. Loan apps, with their fixed terms and short repayment periods, aren’t built for this reality. A flexible credit tool like MAXIM ensures that you’re always prepared.

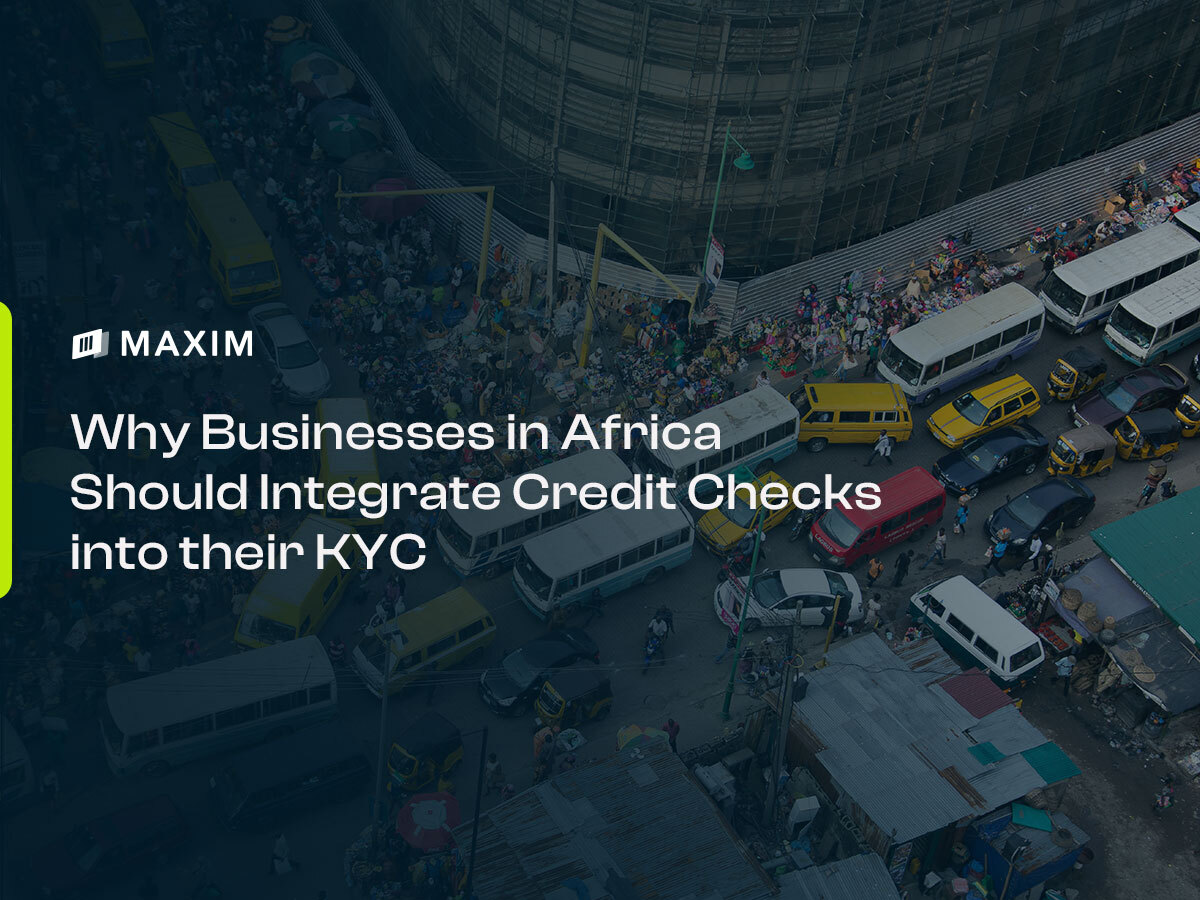

Expanding Financial Inclusion

According to the World Bank, Nigeria’s access-to-credit gap affects 80% of income earners, who are unable to secure loans or other credit options. MAXIM aims to bridge this gap by providing accessible and flexible credit to more Nigerians.

Supporting Small Businesses

For entrepreneurs, flexibility is key. Whether it’s purchasing inventory, managing cash flow, or investing in growth, the MAXIM Credit Card’s higher limits and revolving credit line allow business owners to operate confidently.

Real-Life Scenarios: How MAXIM Delivers Flexibility

Scenario 1: Managing Irregular Income

Chidi, a freelance graphic designer in Abuja, experiences irregular income patterns. Traditional loans don’t work for him because repayment schedules clash with his cash flow. With MAXIM, Chidi uses the card to cover expenses during slow months and repays during busier times, without penalties.

Scenario 2: Emergency Medical Bills

When Bola’s son fell ill, she needed ₦150,000 urgently. Loan apps capped her borrowing at ₦50,000, forcing her to scramble for alternatives. MAXIM provided a higher credit limit with flexible repayment options, helping her navigate the crisis stress-free.

Scenario 3: Scaling a Side Hustle

Funke, an online clothing seller, needed funds to stock up for a Black Friday sale. Loan apps didn’t offer the amount she needed. MAXIM gave her the spending power to invest in her business, and the rewards points she earned offset her repayment costs.

The Financial Future of Nigerians: Why MAXIM Is the Key

As Nigeria continues to evolve economically, financial access is crucial for personal and professional growth. The World Bank notes that less than 5% of Nigerians have access to formal credit, yet credit is one of the most important tools for financial independence and business growth.

MAXIM Credit Card aims to change this by offering an accessible, flexible, and rewarding financial solution to Nigerians who are ready to take control of their finances. By combining the best features of credit cards, like higher limits, flexibility, and credit-building benefits, MAXIM offers a path to financial empowerment.

Get Started with MAXIM Today

Getting your hands on a MAXIM Credit Card is simple.

- Apply for the Expense Card: Start building your credit and earn reward points from day one.

- Upgrade to MAXIM Credit Card: Gain higher limits and greater flexibility once you’ve built a financial foundation.

- Unlock Greater Financial Freedom: Use your MAXIM Credit Card to reach your financial goals, whether that’s funding your business, managing personal expenses, or improving your creditworthiness.

If you’re ready to go beyond the restrictions of loan apps and tap into the true flexibility that modern financial products offer, the MAXIM Credit Card is your ultimate solution. With higher credit limits, zero-low interest rates, and the ability to build your credit score, MAXIM helps you achieve your financial goals while giving you the freedom to manage your finances on your own terms.

Don’t settle for less. Experience financial flexibility like never before with MAXIM Credit Card.