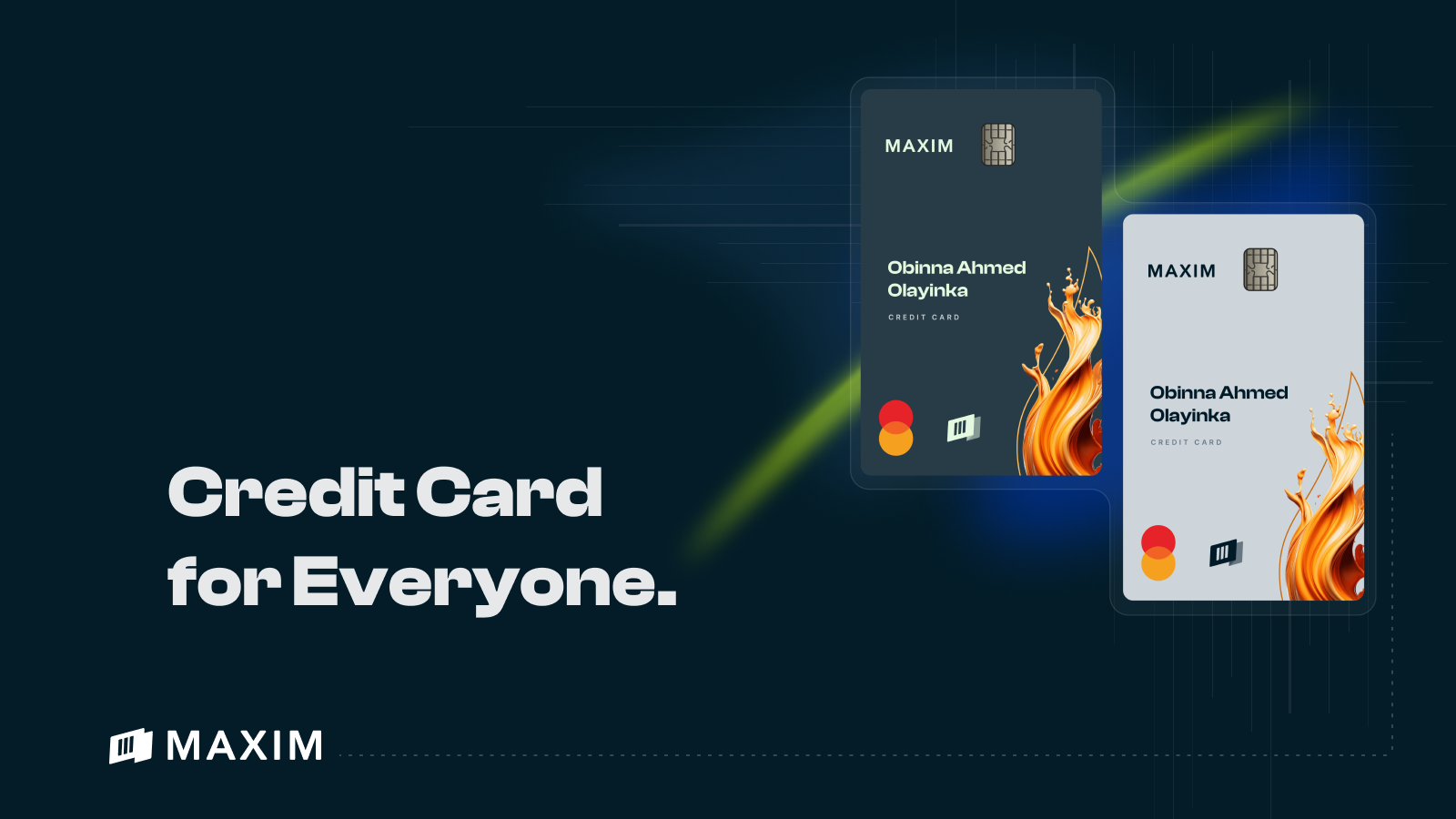

Do You Need More Than a Loan Can Offer? MAXIM Credit Card Delivers.

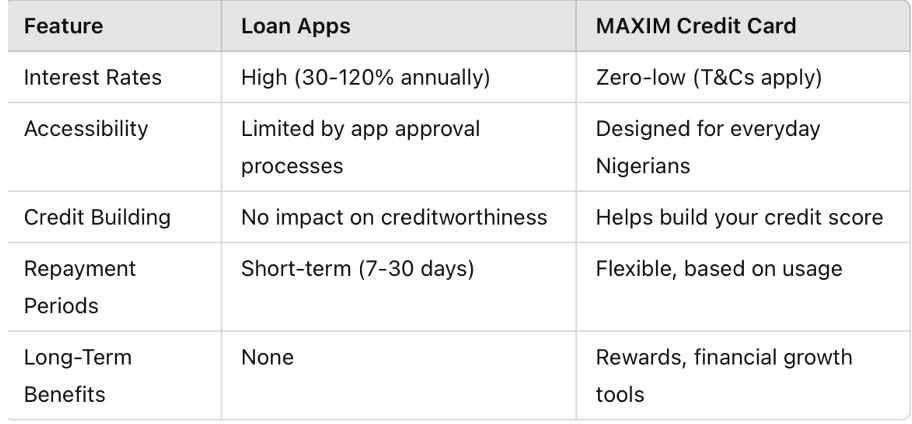

For many Nigerians, loan apps have become the go-to solution for quick financial fixes. While these apps might seem convenient, they often come with limitations: high-interest rates, short repayment periods, and no long-term benefits like credit building.

Enter the MAXIM Credit Card, a modern financial tool designed to provide more than just temporary relief. MAXIM is here to revolutionize how Nigerians think about credit by offering a smarter, long-term solution that empowers users to achieve financial stability and freedom.

Beyond the Limits of Loan Apps

Loan apps are popular for a reason—they’re fast and accessible. But when you look closer, the cracks begin to show:

- High Costs: Most loan apps charge interest rates that can climb as high as 120% annually, draining borrowers over time.

- Short-Term Thinking: Loans are often designed for quick repayment, with little room for financial planning or growth.

- No Lasting Benefits: Repaying a loan doesn’t improve your financial standing or creditworthiness in the long run.

If you’re tired of these limitations, the MAXIM Credit Card offers a way out. It’s not just a solution; it’s an upgrade to your financial life.

What Makes MAXIM Credit Card a Game-Changer?

MAXIM isn’t just a credit card; it’s a reimagined approach to financial empowerment. Here’s why it’s the perfect tool for those who want more than a loan can offer:

1. Low-Cost Credit Options

Loan apps often trap users in cycles of debt due to exorbitant interest rates. With the MAXIM Credit Card, users enjoy zero-low interest rates (T&Cs apply), ensuring that borrowing remains affordable.

2. Revolving Credit Line

Forget the hassle of reapplying for loans every time you need credit. MAXIM provides a revolving credit line, allowing you to access funds anytime within your limit.

3. Build Your Creditworthiness

Every responsible transaction with MAXIM helps build your credit score. This is crucial in a country where formal credit access is limited—only 4% of Nigerians have credit cards, according to a report by Statista. MAXIM gives you a chance to join this exclusive group and elevate your financial profile.

4. Rewards That Work for You

With MAXIM, every swipe earns you points that can be redeemed for exclusive perks or used to increase your credit limit. This encourages responsible spending and gives you tangible benefits for good financial habits.

5. Financial Literacy Support

MAXIM is committed to empowering its users with knowledge. Through its platform, users gain access to financial education tools that help them make informed decisions about borrowing, saving, and spending.

The Nigerian Credit Landscape: A Gap Waiting to Be Filled

The numbers speak for themselves:

- 70% of Nigerian adults lack access to formal credit systems, according to EFInA’s Access to Financial Services Survey.

- Loan app users often struggle with repayment, with over 50% reporting difficulties in meeting short repayment deadlines.

- Credit cards are still underutilized, with only 2% of Nigerian adults using them as a financial tool.

MAXIM is bridging this gap by providing a credit card designed for Nigerians’ unique needs.

Why MAXIM Outshines Traditional Loans

Real Stories: How MAXIM Transforms Lives

Ada’s Journey to Financial Freedom

Ada, a small business owner in Abuja, relied on loan apps to restock inventory. The high interest rates and constant reapplications made her finances unpredictable. Switching to the MAXIM Credit Card gave her access to a revolving credit line, helping her manage her cash flow without the constant stress of debt repayment.

“I feel in control for the first time,” says Ada. “MAXIM isn’t just credit—it’s a financial partner.”

The MAXIM Promise

MAXIM isn’t just another credit solution; it’s a movement toward financial empowerment. By prioritizing affordability, accessibility, and growth, MAXIM is reshaping how Nigerians think about credit.

Key Benefits of the MAXIM Credit Card:

- Save More: Say goodbye to high-interest loans and hello to affordable credit.

- Grow Your Credit Profile: Build a foundation for larger financial opportunities.

- Enjoy Rewards: Turn everyday transactions into points that work for you.

- Plan Flexibly: Access credit when you need it without the constraints of traditional loans.

Ready to Start Your MAXIM Journey?

Getting started is simple:

- Apply for the Expense Card: If you’re new to credit, begin with MAXIM’s free Expense Card to build good financial habits.

- Earn and Learn: Use the card to earn points while learning about smart financial management.

- Upgrade to MAXIM Credit Card: Once eligible, enjoy the full benefits of a credit card tailored for your financial goals.

Loans might offer temporary relief, but the future of credit lies in solutions that empower users for the long term. With the MAXIM Credit Card, you’re not just borrowing money—you’re investing in your financial independence.

Leave loans behind and embrace growth. Apply for MAXIM today!