Global access to credit and financial data for innovative businesses.

Leverage the power of real-time consumer data from Credit Bureaus and Financial Institutions to make appraisals and underwriting decisions with our customizable API, dashboard, SDKs and plugins.

Our offerings

Robust Financial and Non-financial Data StackOur foundation is built on a comprehensive data ecosystem. MAXIM connects seamlessly with Credit Bureaus, insurance records, Open Banking APIs, and other alternative data sources. This wealth of data forms the bedrock for informed underwriting and appraisal decisions.

AI-Powered

Precision StackAt the heart of MAXIM's solution lies advanced Machine Learning (ML) models. These cutting-edge technologies enable businesses and service providers to underwrite loan and credit products with unparalleled precision. Analyzing data trends, assessing risk factors, and providing real-time insights that drive smarter appraisal and underwritting decisions.

Precision StackAt the heart of MAXIM's solution lies advanced Machine Learning (ML) models. These cutting-edge technologies enable businesses and service providers to underwrite loan and credit products with unparalleled precision. Analyzing data trends, assessing risk factors, and providing real-time insights that drive smarter appraisal and underwritting decisions.

Reporting or Furnishing StackIn the ever-evolving world of credit access, collaboration is key to success, but data silos often obstruct progress.

At MAXIM, we're dedicated to simplifying the complex landscape of data reporting and enhancing accuracy, whether you're pioneering innovative credit solutions or assisting individuals in building their credit history.Our mission is to create a seamless credit ecosystem where collaboration and data accuracy intersect, ensuring that everyone has equitable access to the most updated and accurate data information to make underwriting and appraisal decisions.

Repayment or Recollection StackOur automated repayment and collections stack is a pioneering solution designed to address credit challenges in regions with weaker creditor rights and contract enforcement difficulties.

This innovative technology is a game-changer, enabling the automatic collection and timely repayment of credit according to the terms specified in the contract.This stack goes beyond traditional approaches, offering a dependable and efficient means of ensuring contractual obligations are met, minimizing risks, and supporting a more stable credit ecosystem.

Full stack product

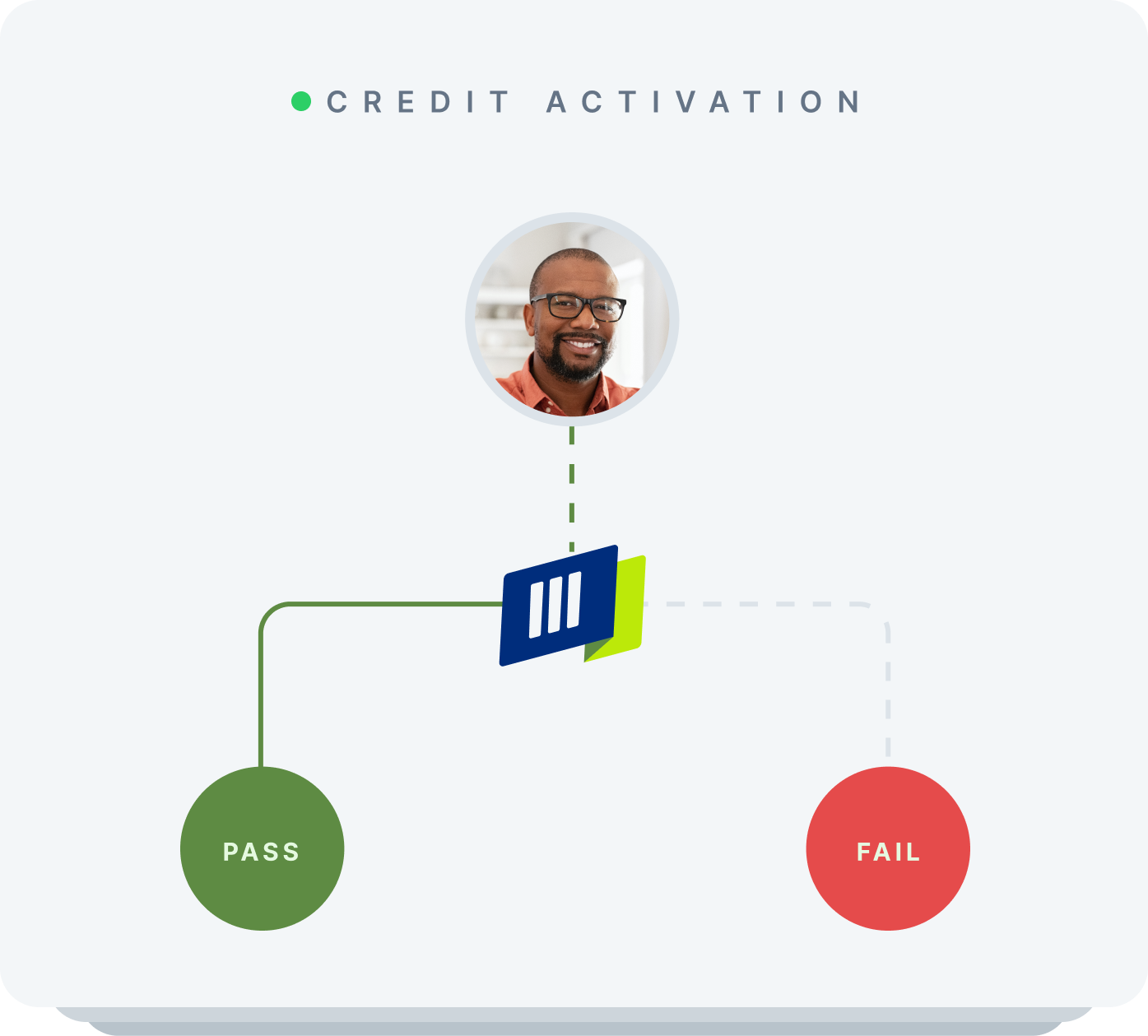

OmnicredA comprehensive credit-activation suite integrated with recollection or repayment stack.

~ Credit and Credibility for all ~

At Maxim, our central mission revolves around driving widespread credit adoption and accessibility. We firmly believe that building the core infrastructure that allows just about any business to “switch on” credit is the key.

Our OMNICRED product unites multiple stacks to simplify credit activation for any business or service provider. It manages automated qualifications and appraisal, incorporating our powerful recollection or repayment stack into one robust package.This enables businesses of all sizes and forms to activate credit with ease, levelling the playing field and contributing to economic growth in emerging markets.

SOLUTIONS CRAFTED FORService providers, Cross-border Enterprise and Businesses looking to expand their horizonMAXIM's infrastructure is designed to power a vast array of credit-based services, making it a versatile solution for a wide range of industries and business models. MAXIM is the answer to power your credit services and products.

Activate credit in 5 easy steps

Sign up for a demo

Customized credit solution deployment

Onboarding and integration

Access to sandbox and comprehensive documentation

Go live, go credit