Maxim Credit Card : A New Era in Nigerian Credit Ecosystem

The Nigerian financial and credit ecosystem has been crying out for a fresh, game-changing solution, and Maxim Credit Card is here to answer that call. If you’re tired of payday loans that drag you through tedious application processes, pile on sky-high interest rates, and leave you with no real financial flexibility, then you’re in the right place. Maxim is flipping the script, bringing a credit revolution that goes beyond just a single transaction—it’s about leveling up your lifestyle and building long-term financial health.

So let’s dive into what makes Maxim Credit Cards the hottest option in town. Ready? Let’s go!

The Nigerian Credit Landscape: Why Maxim is Different

Before we get into all the amazing perks Maxim offers, let’s talk about the reality of existing alternatives. Most Nigerians looking for credit right now are stuck with payday loans, which have some serious downsides:

- High Interest Rates: Payday loans often come with outrageously high interest rates, leaving you wishing you’d never taken out credit in the first place. But remember, you’re not to blame for seeking financial support—consumer credit is a core part of every economically advanced society. The real issue is the lack of fair, accessible options, not your choice to use them.

- Tedious Application Process: Each time you need to re-apply, you’re back to square one—paperwork, waiting periods, and lots of frustration.

- Single-Purpose Transactions: Payday loans are one-time deals. There’s no revolving credit, meaning once you repay it, you have to apply again if you need more. No flexibility, no long-term benefits.

- No Impact on Lifestyle or Long-Term Financial Health: Let’s face it, payday loans don’t improve your financial health, and they certainly don’t come with perks that upgrade your lifestyle.

Maxim Credit Cards are here to change that. Say goodbye to high-interest, single-purpose loans, and hello to revolving credit, rewards, and a better way to manage your finances.

What Makes Maxim Credit Cards a Game Changer?

So, how exactly is Maxim rewriting the rules? Here’s why our credit card is the breath of fresh air Nigeria’s financial market needs:

1. Revolving Credit: Your Financial Flexibility Just Got Real

Maxim offers revolving credit, which means you have ongoing access to credit as long as you keep paying off what you owe. No more re-applying for payday loans or waiting for approval each time you need funds. With Maxim, once you’re approved, you’re good to go, forever! 💸

2. Zero Interest rates (T&C applies).

Enough with the 20%-60% per month madness you see with payday loans. MAXIM does not charge interest rates on our cards (T&C applies), once you subscribe to a membership plan, you have access to revolving credit in your card month on month. Please note that other charges may apply to each membership plan.

3. Easy Application & Instant Decisions

We hate paperwork as much as you do. Maxim’s application process is smooth and simple, plus, you get instant decisions on your approval status. Whether you’re at home or on the go, applying for a Maxim Credit Card is a breeze.

4. Rewards and Perks: Leveling Up Your Lifestyle

Here’s where Maxim really shines. Unlike payday loans, which only take from you, Maxim Credit Cards give back. From cashback rewards to exclusive perks like travel discounts, lounge access, and VIP experiences, we’re here to help you enjoy life to the fullest.

5. Building Long-Term Financial Health

Maxim isn’t just about instant gratification. We’re here to help you build your financial future. With responsible use of your Maxim Credit Card, you can boost your credit score, making it easier to access better financial opportunities down the line. Think of it as an investment in your financial wellness.

Maxim Credit Card Tiers: Something for Everyone

We understand that one size doesn’t fit all, so we offer multiple membership tiers to fit your lifestyle and spending habits. Whether you’re just starting your credit journey or you’re ready for top-tier luxury, Maxim has the right card for you.

1. Premier Membership

Our entry-level card gives you all the basics with low fees and solid perks. Perfect for those new to credit or looking to build their financial profile.

2. Elite Membership

This is for those who have paid their dues and are ready to spread their wings

3. Signature Membership

Step it up with Signature. This card offers bigger rewards, exclusive perks, and a higher credit limit, giving you more room to spend and enjoy life.

3. Prestige Membership

Ready for VIP treatment? Prestige is the top-tier membership for those who want it all—travel benefits, fine dining experiences, and access to luxury lounges worldwide. Your lifestyle, is elevated.

The Maxim Expense Card: A Starting Point for All

What if you’re not eligible for a Maxim Credit Card just yet? Don’t worry—we’ve got you covered with the Maxim Expense Card. This expense card is designed to help you build credit while enjoying access to a savings account and earning points through regular usage, savings, and even referrals. Accumulate enough points, and you can upgrade to a Maxim Credit Card, leveling up your financial status over time.

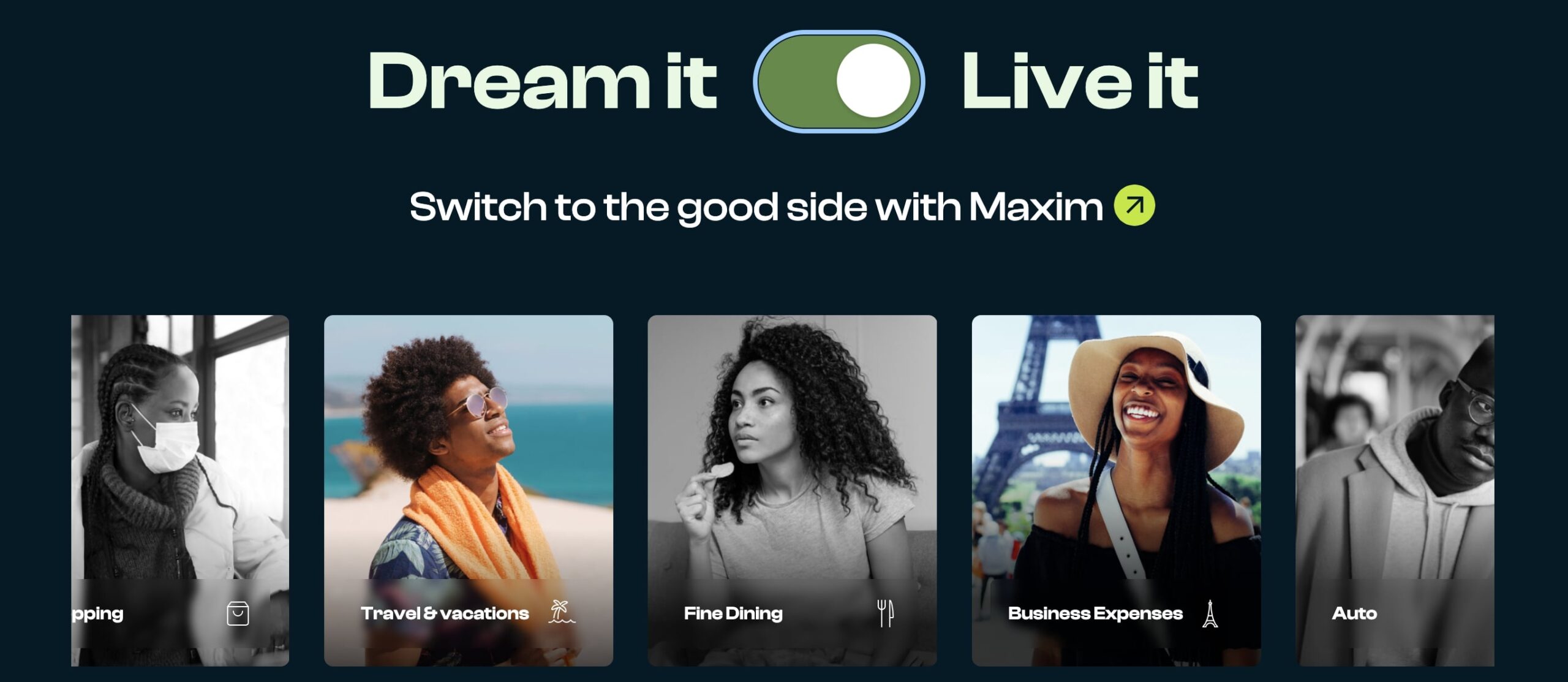

Why Maxim? It’s Not Just a Card—It’s a Lifestyle

Maxim isn’t just about providing credit. We’re about offering a complete lifestyle experience that empowers you to make smarter financial choices, organize and plan your finances, give you better control of your overall finances, travel more, and live better. Whether you’re using your Maxim Card for everyday purchases, booking a vacation, or accessing exclusive experiences, we’ve got your back.

With Maxim—you’re stepping into a community that prioritizes your long-term financial health, rewards your loyalty, and offers unparalleled convenience.

Say Goodbye to Payday Loans and awkward borrowing from family and friends and Hello to Maxim

So, why stick with payday loans that limit your options and charge through the roof? With Maxim Credit Cards, you get flexibility, rewards, and a long-term path to financial wellness. Plus, we’re making sure that every transaction has the potential to boost your lifestyle—whether it’s a simple grocery run or a luxury vacation.

Ready to Make the Switch to the Good Side?

The choice is clear: Maxim Credit Cards are designed to give you the financial freedom you deserve. If you’re ready to ditch the payday loan hustle and take control of your financial future, Maxim is here for you.

Welcome to the future of credit in Nigeria. Welcome to Maxim